Quick Takeaways

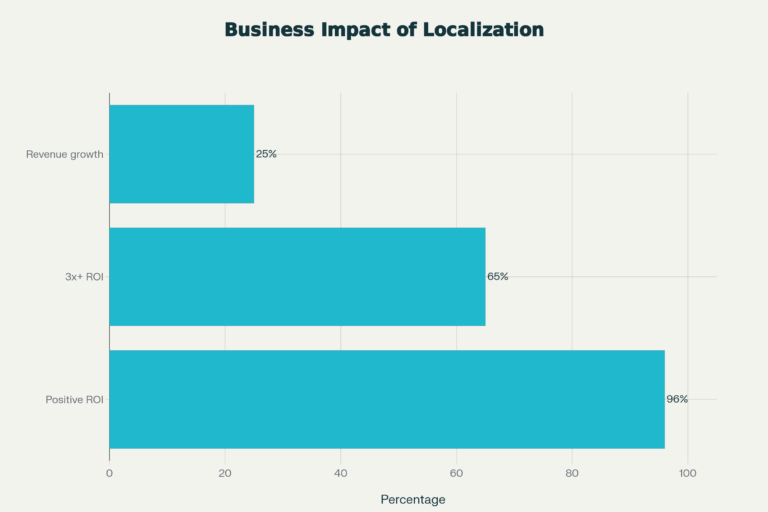

If you only do one thing: Prioritize localization as a core growth strategy, not an afterthought—96% of companies report positive ROI from localization efforts, with 65% achieving 3x or greater returns.

Localization drives measurable business impact: companies see 20-30% revenue growth and up to 70% conversion rate increases when implementing full localization strategies

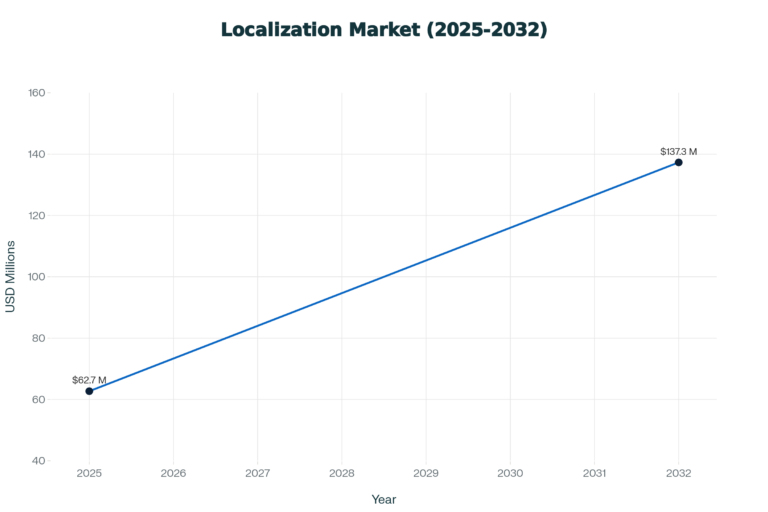

The global localization strategies market is projected to grow from USD 62.7 million in 2025 to USD 137.3 million by 2032, representing an 11.8% CAGR

65% of consumers prefer content in their native language, and 40% won’t buy from websites in other languages

Asia Pacific shows the fastest growth in localization adoption at 25.3% market share, with cross-border e-commerce expected to grow at 11.2% CAGR through 2030

Strategic localization goes beyond translation—it encompasses cultural adaptation, payment methods, customer support, regulatory compliance, and user experience optimization

Who This Playbook Is For (And Not For)

This framework is ideal for:

B2B companies planning expansion into Asian markets with products or services ready for international adoption

E-commerce businesses looking to capture cross-border opportunities in high-growth regions like Southeast Asia, where 70%+ of online shoppers make cross-border purchases

SaaS platforms aiming to scale beyond their home market and establish product-market fit in culturally diverse regions

Companies with existing products seeking to validate market fit before building local teams or making significant infrastructure investments

Organizations ready to invest in strategic localization, not just basic translation, to drive sustainable growth

This playbook is NOT for:

Businesses expecting localization to be a one-time translation project rather than an ongoing strategic initiative

Companies unwilling to adapt their products, messaging, or business models to local market needs

Organizations seeking quick wins without investing in proper market research and cultural understanding

Why Localization Is Your Competitive Advantage

Localization isn’t optional anymore—it’s the difference between thriving and failing in international markets. The numbers tell a compelling story: 96% of companies implementing localization strategies report positive ROI, with 65% achieving returns of 3x or greater. Companies that prioritize localization see 20-30% revenue growth and can expand market reach by 10-15% with just one additional language.

The Business Impact of Localization – ROI metrics showing that 96% of companies report positive returns from localization efforts

The impact on conversion rates is even more dramatic. While non-localized experiences generate baseline performance, companies localizing for two markets see 16.42% conversion growth. Those targeting three or more markets achieve 18.22% increases, and businesses implementing full localization strategies experience up to 70% conversion rate improvements.

Conversion rate increases by localization level, showing up to 70% improvement with full localization implementation

The global localization market reflects this growing importance. Projected to expand from USD 62.7 million in 2025 to USD 137.3 million by 2032 at an 11.8% CAGR, localization has become a fundamental business strategy. Translation services alone are expected to hold 51.2% market share in 2025, driven by surging cross-border communication needs.

Localization Market Growth showing projected increase from USD 62.7 million in 2025 to USD 137.3 million by 2032, representing an 11.8% CAGR

Consumer behavior reinforces why localization matters: 65% of online shoppers prefer content in their native language, even if the quality is poor, and 40% won’t purchase from websites in other languages at all. This language barrier directly impacts your bottom line—when customers can’t engage with your content in their preferred language, they simply go elsewhere.

Localization delivers strategic advantages beyond revenue:

Enhanced customer engagement: Localized campaign creatives outperform English versions by 86% in both click-through rates and conversion rates

Improved customer loyalty: Businesses prioritizing localization report a 47% increase in customer loyalty and 53% boost in customer satisfaction

Faster market penetration: Culturally relevant translations accelerate international growth by improving market entry, customer trust, and brand consistency

Competitive differentiation: Companies that localize early gain first-mover advantages and establish strong market positions before competitors adapt

Yet many companies still treat localization as an afterthought, focusing only on basic translation. This approach fails because true localization encompasses cultural adaptation, visual elements, payment preferences, customer support, regulatory compliance, and user experience optimization. Companies that understand this holistic approach gain measurable competitive advantages in target markets.

Step 1 – Diagnose Your Current State

Before investing in localization, you need a clear understanding of where you stand. This diagnostic phase prevents costly mistakes and helps you allocate resources effectively.

Assess your current international readiness:

Market signals analysis: Review your existing website analytics to identify where your international traffic originates. Look for patterns showing sustained interest from specific regions or countries. High bounce rates from certain geographies often signal language barriers or poor localization.

Product-market fit validation: Determine if your product or service has demonstrated traction in your home market. Successful domestic performance doesn’t guarantee international success, but it provides a foundation. Validate whether your value proposition translates across cultural contexts.

Resource inventory: Evaluate your available budget, team capabilities, and technology infrastructure. Localization requires investment in translation management systems, cultural consultants, payment integrations, and ongoing content maintenance. Understand your constraints before committing to specific markets.

Competitive landscape: Research how competitors approach localization in your target markets. Identify gaps in their strategies and opportunities for differentiation. Study both successful market entries and failures to understand what works.

Create your localization readiness checklist:

✓ Content audit: Catalog all content requiring localization—website pages, product descriptions, marketing materials, customer support documentation, legal terms, and user interfaces

✓ Technical infrastructure: Verify your platforms support multi-language content, right-to-left scripts, various character sets, and locale-specific formats for dates, currencies, and measurements

✓ Cultural sensitivity review: Identify imagery, colors, symbols, and messaging that may require adaptation for different cultural contexts

✓ Legal and compliance requirements: Research regulatory obligations, data localization laws, and industry-specific compliance needs in target markets

✓ Customer support capabilities: Assess your ability to provide multilingual customer service across different time zones

Key metrics to establish baseline performance:

Track these metrics before launching localization efforts so you can measure impact accurately:

Current conversion rates by geographic region

Average order value or deal size by country

Customer acquisition cost for international visitors

Bounce rates and time-on-site for non-domestic traffic

Customer support inquiry volume and resolution time

Revenue contribution from international markets

This diagnostic phase typically takes 2-4 weeks but saves months of misdirected effort. Companies that skip this step often waste resources on markets with limited potential or fail to address critical infrastructure gaps.

Step 2 – Prioritize and Select Target Markets

Not all international markets deserve equal attention. Strategic prioritization maximizes ROI by focusing resources on markets with the highest growth potential and best fit for your offering.

Use a data-driven prioritization framework:

Market attractiveness scoring: Evaluate potential markets across multiple dimensions:

Market size and growth rate: Assess total addressable market and projected growth. Asia Pacific, for example, shows 25.3% market share in localization adoption with 11.2% CAGR for cross-border e-commerce in Southeast Asia through 2030

Economic indicators: Consider GDP per capita, purchasing power parity, and digital infrastructure maturity

Competitive intensity: Analyze market saturation and identify underserved niches

Regulatory environment: Factor in ease of doing business, data localization requirements, and compliance complexity

Cultural proximity: Assess how closely target market values and business practices align with your company culture

Strategic market entry approaches:

Staged expansion model: Start with markets showing strong organic interest, then expand systematically. Netflix successfully used this approach, first entering Canada before tackling more complex markets.

Regional hub strategy: Establish presence in regional business centers that provide access to multiple markets. Singapore serves as an ideal hub for Southeast Asia expansion, offering favorable infrastructure, strategic location, and robust legal frameworks.

Language-based clustering: Group markets by shared languages to maximize translation investments. Spanish-language content, for instance, serves multiple Latin American markets.

Priority market selection for Asia expansion:

Based on current market dynamics and growth trajectories, consider these high-potential Asian markets:

Tier 1 (Highest priority):

Singapore: Business-friendly environment, high digital adoption, regional gateway with USD 67.40 average basket size—highest in Southeast Asia

Japan: Sophisticated market with high purchasing power, though requiring deep cultural localization and integration with local platforms like LINE

China: Massive market opportunity but demands full platform localization including WeChat integration, Alipay support, and compliance with strict data residency laws

Tier 2 (Strong growth markets):

Vietnam: Fast-growing e-commerce market with 11.2% CAGR for cross-border commerce, though requiring navigation of data localization regulations

Thailand: Strong digital wallet adoption with 83% of buyers influenced by affiliate commerce, preferring mobile-first strategies

Indonesia: Largest Southeast Asian market by population, high e-commerce growth, but complex regulatory environment requiring local payment methods like QRIS

Tier 3 (Emerging opportunities):

Philippines: Youthful digital demographic, mobile-first users, strong English proficiency reducing language barriers

Malaysia: Diverse market with multiple languages, strong e-commerce infrastructure, moderate regulatory complexity

India: Enormous market with rapidly growing digital economy, though requiring adaptation to price sensitivity and diverse regional preferences

Market prioritization checklist:

Before committing to a market, validate these critical factors:

✓ Presence of existing demand signals (website traffic, inbound inquiries, competitor success)

✓ Acceptable regulatory and compliance requirements within your capabilities

✓ Availability of local payment methods your business can integrate

✓ Feasible logistics and fulfillment infrastructure

✓ Sufficient market size to justify localization investment

✓ Cultural and business practice compatibility with your model

The cost of poor market selection: Companies that enter markets without proper prioritization face diluted resources, inconsistent execution, and suboptimal returns. Amazon’s failure in China, attributed largely to inadequate localization and poor understanding of local competitive dynamics, demonstrates the importance of strategic market selection.

Conversely, companies like OPPO achieved dominant positions in Southeast Asia through staged, deeply localized expansion—first establishing footholds in Indonesia and Vietnam, then systematically expanding to become top-ranked in Philippines, Thailand, and Malaysia.

Step 3 – Build Your Localization Framework

A robust localization framework transforms ad hoc translation efforts into a systematic, scalable process. This framework serves as your operational blueprint for all international expansion activities.

Establish your localization governance structure:

Define roles and responsibilities:

Localization manager: Oversees strategy, vendor relationships, and quality assurance

Cultural consultants: Provide market-specific insights on customs, preferences, and sensitivities

Translation team: Native speakers with subject-matter expertise in your industry

Technical integration specialists: Ensure platforms support multi-language requirements

Legal and compliance advisors: Navigate regulatory requirements and data localization laws

Create your localization strategy document:

Your strategy should clearly articulate:

Primary objectives: Revenue targets, market share goals, customer acquisition targets for each market

Key performance indicators: Specific, measurable metrics tied to business outcomes (conversion rates, revenue per market, customer satisfaction scores)

Budget allocation: Resources assigned to translation, technology, cultural adaptation, and ongoing maintenance

Timeline and milestones: Phased rollout schedule with clear deliverables and deadlines

Quality standards: Linguistic accuracy requirements, cultural appropriateness guidelines, brand consistency parameters

Implement a translation management system (TMS):

Technology infrastructure streamlines localization workflows and ensures consistency:

Core TMS capabilities to prioritize:

Centralized content repository: Single source of truth for all translatable content, glossaries, and translation memory

Workflow automation: Automated routing of content to translators, reviewers, and approvers, reducing manual coordination overhead

Integration capabilities: Seamless connections with your CMS, e-commerce platform, CRM, and development tools (GitHub, Jira, Figma)

Translation memory: Reuse of previously translated content to reduce costs and ensure consistency across projects

Quality assurance tools: Automated checks for terminology consistency, formatting errors, and cultural appropriateness

Multi-format support: Handling of various file types including JSON, XML, PO, YAML, and proprietary formats

Leading TMS platforms include Transifex (comprehensive automation and 887 language support), XTM Cloud (enterprise-focused with 60+ integrations), Lokalise (developer-friendly with continuous localization), and Smartling (combined platform and translation services).

Develop localization workflow processes:

Standard operating procedures ensure consistent quality:

Content preparation phase:

Extract translatable content from source materials

Remove hard-coded text and externalize strings for dynamic replacement

Provide contextual information to translators (screenshots, usage notes, target audience details)

Create glossaries defining industry-specific terminology and brand voice guidelines

Translation and adaptation phase:

Assign content to qualified native speakers with relevant subject-matter expertise

Implement review cycles with in-country cultural consultants

Validate that translations convey intended meaning, not just literal word-for-word conversion

Adapt cultural references, idioms, humor, and examples to resonate with local audiences

Quality assurance and testing phase:

Linguistic QA: Verify grammar, spelling, punctuation, and terminology consistency

Functional testing: Ensure UI elements display correctly, text doesn’t overflow containers, and all features work in target languages

Cultural appropriateness review: Validate imagery, colors, symbols align with local norms

In-market user testing: Gather feedback from representative users in target markets before full launch

Publication and maintenance phase:

Deploy localized content through over-the-air updates or version releases

Monitor performance metrics to identify improvement opportunities

Establish processes for updating translations when source content changes

Create feedback loops capturing customer and support team insights on localization quality

Build translation memory and terminology databases:

These assets become increasingly valuable over time, reducing costs and accelerating future localization:

Translation memory: Repository of previously translated sentence pairs enabling automatic matching for recurring content

Glossaries: Approved translations for product names, technical terms, and brand-specific vocabulary ensuring consistency

Style guides: Voice, tone, and formatting guidelines maintaining brand identity across languages

Companies implementing structured localization frameworks report significant efficiency gains—translation management systems can accelerate localization processes by up to 80% while reducing costs through reuse of translation memory.

Step 4 – Implement Full-Stack Localization

Basic translation addresses only surface-level needs. Full-stack localization adapts every layer of your business model to local market realities, creating genuinely native experiences.

Language and content localization:

Go beyond word-for-word translation to adapt meaning, emotion, and cultural context:

Transcreation: Recreate marketing messages and slogans to convey the same emotional impact in target languages, even if literal translation differs

Cultural adaptation: Modify idioms, humor, metaphors, and references that don’t translate across cultures

SEO localization: Research and implement keywords that local users actually search for, which often differ from direct translations

Content restructuring: Adjust information hierarchy, paragraph length, and writing style to match local content consumption preferences

Visual and design localization:

Visual elements carry cultural meaning that varies dramatically across markets:

Color symbolism: White represents purity in Western cultures but signifies mourning in many Asian contexts. Red conveys luck and prosperity in China but can signal danger elsewhere

Imagery and photography: Use visuals featuring people, settings, and scenarios that reflect target audience demographics and cultural contexts

Icon and symbol adaptation: Ensure icons communicate intended meanings—a mailbox icon meaningful in one culture may be unrecognizable in another

Layout and typography: Accommodate text expansion (German can be 30% longer than English) and right-to-left scripts (Arabic, Hebrew)

Design conventions: Align with local UX patterns—Japanese users expect feature-rich interfaces while Western users prefer minimalism

Technical and functional localization:

Your platform infrastructure must support diverse market requirements:

Date and time formats: Implement locale-specific formatting (MM/DD/YYYY vs. DD/MM/YYYY)

Number and currency display: Proper thousands separators, decimal points, and currency symbols

Address formats: Support varying address structures across markets—some require postal codes before city names, others use different organizational hierarchies

Phone number validation: Accommodate different phone number lengths and formats

Measurement systems: Convert between metric and imperial units as appropriate

Character encoding: Support special characters, accents, and non-Latin scripts (Chinese, Japanese, Korean, Arabic, Cyrillic)

Legal and regulatory compliance localization:

Compliance requirements vary significantly across markets and carry serious consequences if ignored:

Data localization and privacy:

China: Strict data residency requirements under Cybersecurity Law, Data Security Law, and Personal Information Protection Law mandate local storage for personal data and “important data”

Vietnam: Cybersecurity Law requires data localization for certain categories, with complex overlapping requirements across multiple regulations

Indonesia: Public electronic systems operators must maintain data locally

Singapore: No general localization requirements but sector-specific obligations in banking, insurance, and healthcare

Industry-specific regulations: Financial services, healthcare, and telecommunications face heightened regulatory scrutiny requiring specialized compliance strategies.

Terms of service and legal disclaimers: Adapt contracts, privacy policies, and terms to comply with local consumer protection laws and legal frameworks.

Marketing and brand localization:

Effective marketing requires understanding what motivates customers in each market:

Channel adaptation: Platforms dominating one market may be irrelevant in another:

China: WeChat dominates social commerce and communication

Japan: LINE serves as primary messaging and content platform

South Korea: KakaoTalk for messaging, Naver for search

Southeast Asia: TikTok has rapidly gained traction across the region

Campaign timing: Align promotions with local holidays, festivals, and seasonal events rather than forcing Western calendar events.

Influencer partnerships: Collaborate with local influencers and brand ambassadors who authentically connect with target audiences.

Community building: Engage with local communities through region-specific social media campaigns and localized content.

Product and service localization:

The most successful companies adapt core offerings to local preferences:

Product adaptation examples:

IKEA in China: Initially struggled because Chinese consumers didn’t want to assemble furniture themselves. IKEA partnered with local firms to offer assembly services at checkout

Starbucks in Japan: Introduced more tea options, smaller serving sizes, less sweet beverages, and exceptional customer service matching Japanese expectations

KFC in China: Developed entirely new menu items incorporating local ingredients and flavors, including congee and egg tarts

Service model adaptation:

Grab in Southeast Asia: Beat Uber by offering GrabBike (motorcycle taxis) suited to heavily congested traffic, cash payment options for unbanked populations, and deep integration with local ecosystems

Companies treating products as fixed and only localizing marketing consistently underperform those willing to adapt offerings to local needs

Step 5 – Optimize Payment and Customer Experience

Payment friction and poor customer experience destroy conversions, even with perfect content localization. These operational elements directly impact your bottom line.

Implement localized payment methods:

Payment preferences vary dramatically across Asia, and offering only credit cards excludes massive customer segments:

Southeast Asia payment landscape:

Digital wallets dominate: 87% of all e-commerce transactions in Southeast Asia are now digital, with wallets like GCash (Philippines), TrueMoney (Thailand), Dana (Indonesia), and GrabPay (regional) serving as standard payment methods

Bank transfers remain critical: FPX (Malaysia), PromptPay (Thailand), and DuitNow (Malaysia) enable real-time bank-to-bank payments

Cash-based alternatives: Many markets still require konbini (convenience store payment) and other cash alternatives for unbanked populations

East Asia payment requirements:

China: Alipay and WeChat Pay are essential—credit cards have limited penetration

Japan: Konbini payments, carrier billing, and local credit options alongside international cards

South Korea: Local payment gateways and mobile carrier billing

The conversion impact is substantial: When shoppers see familiar payment logos at checkout, they’re significantly more likely to complete transactions. Conversely, 77% of shoppers abandon carts when their preferred payment method isn’t available.

Payment localization also accelerates settlements. Local acquiring solutions treat cross-border transactions as connected domestic transfers, enabling next-day or same-day settlement versus traditional multi-day international transfers.

Cross-border payment infrastructure providers like Stripe, Adyen, Antom, Tazapay, and PayerMax simplify integration by connecting merchants with regional payment preferences through unified APIs.

Pricing localization strategies:

Simply converting prices through exchange rates fails to account for local purchasing power and competitive dynamics:

Purchasing power parity: Adjust pricing to reflect local income levels and what customers can afford

Competitive benchmarking: Research what local and international competitors charge in target markets

Value perception: Consider whether your product is positioned as premium, mid-market, or value in each geography

Psychological pricing: Apply local conventions (JPY 1,980 vs. CNY 99.9)

Transparent total cost: Display all fees, taxes, and shipping costs in local currency to prevent checkout abandonment

Multilingual customer support:

Language barriers in customer support create frustration and erode trust:

Support channel localization:

Multilingual knowledge bases: Translate FAQs, how-to guides, troubleshooting documentation, and product information into target languages

Live chat in local languages: Deploy native-speaking support agents or AI-powered chatbots with real-time translation capabilities

Phone support considerations: If offering phone support in target languages isn’t feasible, clearly communicate this limitation to avoid creating false expectations

Time zone coverage: Ensure support availability aligns with peak engagement periods in each market

Cultural adaptation of support interactions:

Communication style: Japanese business culture expects formal, hierarchical communication while Southeast Asian markets may prefer friendlier, more casual interactions

Response time expectations: Research local norms—some markets expect immediate responses while others accept longer resolution timelines

Escalation protocols: Understand how different cultures prefer to handle complaints and disputes

The Philippines has emerged as a premier hub for multilingual customer support outsourcing, offering services in over 40 languages including Spanish, Mandarin, Japanese, Korean, French, German, and Arabic, with cultural alignment and cost-effective operations.

Logistics and fulfillment localization:

The customer experience extends beyond digital interactions to physical delivery:

Local warehousing: Reduce delivery times through in-market inventory positioning

Regional shipping partners: Partner with carriers customers recognize and trust

Clear delivery expectations: Communicate realistic timelines in local business days, accounting for holidays and regional factors

Returns and exchanges: Establish processes aligned with local consumer protection laws and expectations

Customs and duties transparency: Clearly communicate any additional costs customers may incur

Companies successfully navigating these operational complexities report higher customer satisfaction, reduced support inquiry volumes, and improved customer retention.

Step 6 – Measure Success and Scale

What gets measured gets improved. Systematic tracking of localization performance enables data-driven optimization and justifies continued investment.

Key performance indicators for localization:

Revenue and conversion metrics:

Revenue by market: Track revenue contribution from each localized market, comparing pre- and post-localization performance

Conversion rate by locale: Measure how localization impacts the percentage of visitors completing desired actions

Average order value (AOV) by region: Identify whether local pricing and payment options influence purchase size

Customer acquisition cost (CAC): Calculate whether localized experiences reduce the cost of acquiring customers in target markets

Customer lifetime value (CLTV): Assess if localization improves retention and repeat purchase rates

Engagement and experience metrics:

Bounce rate by language: Lower bounce rates indicate content resonates with local audiences

Time on site by locale: Longer session durations suggest visitors find localized content relevant and engaging

Pages per session: Track whether localized users explore more content than non-localized visitors

Language preference usage: Monitor which language options visitors select and whether they switch languages mid-session

Quality and operational metrics:

Translation accuracy scores: Regular linguistic quality assessments ensure translations meet standards

Content update cycle time: Measure how quickly translated content reflects source material changes

Support inquiry volume by language: Track whether localized content and FAQs reduce support burden

Customer satisfaction (CSAT) by market: Compare satisfaction scores across localized and non-localized experiences

Market penetration metrics:

Market share in target countries: Measure your position relative to competitors

Brand awareness and recognition: Survey-based metrics tracking how target audiences perceive your brand

Organic search visibility: SEO rankings for localized keywords indicate discoverability

Social media engagement by market: Likes, shares, comments, and follower growth in region-specific channels

A/B testing for continuous improvement:

Systematically test localization hypotheses to optimize performance:

Language variations: Test different translations or transcreations of the same message to identify what resonates

Cultural adaptations: Compare performance of culturally adapted vs. directly translated content

Pricing strategies: Test different price points and display formats to optimize for local markets

Payment method prominence: Experiment with the order and visibility of local payment options

Visual elements: Test different imagery, color schemes, and design variations for cultural resonance

Compare localized vs. non-localized experiences to isolate localization impact. This controlled approach demonstrates clear ROI to stakeholders.

Calculate localization ROI:

Make the business case for continued investment by quantifying returns:

ROI Formula: (Incremental Revenue from Localization - Localization Costs) / Localization Costs × 100

Consider both direct and indirect benefits:

Direct revenue increases: Additional sales attributable to localized experiences

Cost savings: Reduced customer support inquiries, lower customer acquisition costs

Strategic value: Market positioning, competitive advantages, brand reputation

Research consistently shows strong ROI: 96% of companies report positive ROI from localization, with 65% achieving 3x or greater returns, and average revenue growth of 20-30%.

Scaling successful localization:

Once you’ve validated success in initial markets, scale systematically:

Prioritize next markets using lessons learned from initial launches. Markets with similar cultural characteristics, languages, or consumer behaviors often require less incrementation investment.

Automate and standardize processes that worked well. Your localization framework, translation memory, and operational workflows become increasingly efficient with each market added.

Build a localization center of excellence capturing institutional knowledge, best practices, and market-specific insights. This organizational capability becomes a lasting competitive advantage.

Continuously update localization as markets evolve. Consumer preferences, competitive dynamics, and regulatory requirements change over time, requiring ongoing adaptation.

Real-World Examples: Success and Failure

Learning from both successes and failures accelerates your localization strategy. These cases reveal critical success factors and common pitfalls.

Success Stories

Grab vs. Uber in Southeast Asia: Localization Wins

Situation: Grab started as a small ride-hailing service in Malaysia while Uber operated globally with significant resources.

Trigger: Southeast Asian markets had unique characteristics—heavy traffic congestion, low credit card penetration, and preference for local platforms.

Barrier: Uber applied its standardized global model without significant local adaptation.

Solution: Grab implemented hyper-local strategies:

Offered GrabBike (motorcycle taxis) ideal for congested traffic

Accepted cash payments for unbanked populations

Integrated local payment wallets like GCash and TrueMoney

Partnered with local businesses creating ecosystem benefits

Hired drivers through grassroots outreach at local hangouts

Results: Grab dominated Southeast Asia, forcing Uber to exit the region. Grab achieved nearly $16 billion private valuation and successful IPO by understanding and serving local needs better than global competitors.

OPPO’s Southeast Asia Expansion: Staged Localization Excellence

Situation: Chinese smartphone manufacturer OPPO aimed to expand beyond its home market.

Strategy: Staged expansion starting with Indonesia and Vietnam in 2013, followed by systematic market-by-market growth.

Localization approach:

Reorganized local management replacing those who didn’t understand OPPO’s philosophy with people who identified with the brand

Adapted pricing and features to local preferences and purchasing power

Invested in local marketing and retail presence

Developed region-specific products like affordable folding screen phones capturing 65% market share in Indonesia’s category

Results: By 2018, OPPO achieved dominant positions across Southeast Asia, forming a duopoly with Samsung. In Q3 2023, OPPO became #1 in Southeast Asia shipments, ranking top three in Indonesia, Philippines, Vietnam, Thailand, and Malaysia.

Netflix’s Staged Global Expansion: Strategic Market Prioritization

Approach: Rather than launching globally simultaneously, Netflix expanded to Canada first as a low-risk market with cultural and linguistic similarities to the US.

Validation: This staged approach allowed Netflix to test international operations, validate assumptions, and build capabilities before tackling more complex markets.

Scaling: Netflix then systematically expanded to markets with increasingly different characteristics, applying lessons learned at each stage.

Failure Stories

Amazon in China: Inadequate Localization

Situation: Amazon entered China in 2004, reaching 15.4% market share by 2008.

Trigger: Local competitors Taobao and JD.com invested heavily in localization while Amazon maintained global standardization.

Barriers:

Decision-making centralized in Amazon USA, with leadership neither understanding Chinese market nor trusting local teams

Failed to integrate popular local payment methods Alipay and WeChat Pay

Didn’t adopt local business practices like live-stream shopping

Slow adaptation to mobile-first consumer behavior

Poor logistics compared to competitors’ same-day and next-day delivery

Results: Market share steadily declined. Amazon announced exit from Chinese domestic e-commerce in 2019, and shut down Kindle e-book store in 2023. The lack of localization strategy was cited as a primary failure reason.

Airbnb in China: Cultural Mismatch

Situation: Airbnb entered China with high expectations but struggled for seven years before exiting in 2022.

Barriers:

Cultural differences: Concept of sharing homes with strangers didn’t align with Chinese preferences

Trust issues: Chinese consumers preferred locally-operated platforms over foreign companies

Competitive disadvantage: Local competitor Tujia provided hotel-like experiences better suited to Chinese expectations

Regulatory challenges: Complex legal requirements better navigated by domestic competitors

Inadequate platform localization despite name change and adaptation attempts

Results: Unable to establish sufficient market presence, Airbnb exited China in 2022 after pandemic border closures further impacted operations.

Starbucks in Australia: Misreading the Market

Situation: Starbucks aggressively expanded to Australia in 2000, planning extensive store network.

Trigger: Australia had established coffee culture with personal barista relationships and social café gatherings.

Barriers:

Product mismatch: Starbucks’ commercialized, standardized coffee experience didn’t appeal to Australians preferring local artisanal cafés

Price premium: More expensive than trusted local alternatives

Cultural misalignment: Missed the importance of café culture as social gathering spaces with personal connections

Results: Starbucks closed 61 stores (70% of Australian outlets) in 2008, marking significant retreat from ambitious expansion plans.

Facebook in Japan: Poor Localization Execution

Situation: Facebook entered Japan in 2008 targeting large, dynamic economy.

Barriers:

Established local competitors: Mixi and other platforms already dominated

Cultural norms ignored: Japan’s preference for privacy and anonymity conflicted with Facebook’s real-name, open-sharing model

Poor translation quality: Japanese website translation perceived as “awkward to use”

No differentiation: Failed to articulate why Japanese users should switch from familiar local platforms

Results: Facebook struggled to gain significant traction in Japan, with much lower penetration than in other developed markets.

Key Lessons

From successes: Companies win through deep local understanding, willingness to adapt core offerings, investment in local infrastructure and partnerships, staged market entry allowing learning, and integration of local payment and business practices.

From failures: Companies fail by maintaining rigid global standardization, underestimating local competitors, ignoring cultural preferences and business practices, centralizing decision-making away from local markets, and treating localization as superficial translation rather than strategic adaptation.

These patterns repeat across industries and geographies. The clearest predictor of international success isn’t company size or resources, it’s commitment to genuine localization that respects and serves local market needs.

Your Localization Action Plan

Transform insights into action with this prioritized roadmap. Start with quick wins while building toward long-term strategic capabilities.

Quick Wins (0-30 Days)

Low effort, high impact actions you can implement immediately:

Audit your current state:

Run analytics reports identifying top international traffic sources and their bounce rates

Survey existing international customers about language and payment preferences

Catalog all customer-facing content requiring localization

Document known pain points from international customer support inquiries

Fix low-hanging fruit:

Add language selector to your website if not already present

Translate critical conversion paths (homepage, product pages, checkout) into 1-2 priority languages

Display prices in local currencies for top international markets

Ensure date, time, and number formats adjust based on user locale

Establish baseline metrics:

Set up analytics tracking segmented by country and language

Document current conversion rates, bounce rates, and revenue by market

Create dashboard monitoring key localization KPIs

Mid-Term Actions (30-90 Days)

Building strategic capabilities:

Market selection and strategy:

Complete data-driven market prioritization analysis

Conduct deep-dive research on 2-3 highest-potential markets

Develop market-specific go-to-market strategies

Create localization budget and resource plan

Infrastructure and process:

Select and implement translation management system

Establish localization workflow with defined roles and responsibilities

Build translation memory and terminology glossaries for priority markets

- Internationalize codebase to support multi-language content

Payment and compliance:

Research and integrate priority local payment methods for target markets

Engage legal counsel to understand regulatory requirements

- Implement data localization compliance where required

Adapt terms of service and privacy policies for target jurisdictions

Quality assurance:

Develop localization testing checklist

Recruit native-speaking testers or establish relationships with in-market users

Create feedback loops capturing customer and support team insights

Establish quality standards and review processes

Long-Term Investments (90+ Days)

Scaling sustainably:

Implement comprehensive cultural adaptation across all touchpoints

Localize product features and offerings based on market needs

Build market-specific content strategies aligned with local channels

Establish regional partnerships enhancing market credibility

Operational excellence:

Build or partner for multilingual customer support

Establish in-market logistics and fulfillment capabilities

Create localization center of excellence capturing institutional knowledge

Develop AI-assisted translation workflows improving efficiency

Continuous optimization:

Implement systematic A/B testing program for localized experiences

Regular performance reviews with market-by-market analysis

Update localization based on customer feedback and market evolution

Expand to additional markets applying validated frameworks

Frequently Asked Questions

What’s the difference between translation and localization?

Translation converts text from one language to another, focusing on linguistic accuracy. Localization adapts the entire experience—language, cultural references, visual elements, payment methods, customer support, and business practices—to make it feel native to the target market. Localization includes translation but extends far beyond it.

How much does localization typically cost?

Costs vary based on market complexity, content volume, and localization depth. Basic website translation might cost $5,000-$20,000 per language, while full-stack localization including payment integration, cultural adaptation, and ongoing maintenance can require $50,000-$200,000+ annually per market. However, 96% of companies report positive ROI, with 65% achieving 3x or greater returns, making it a high-value investment.

Which markets should I prioritize for Asia expansion?

Start with markets showing organic demand signals (existing traffic, inquiries). Singapore offers business-friendly entry to Southeast Asia; Japan provides high purchasing power but requires deep localization; Vietnam and Thailand show strong e-commerce growth. Consider factors like market size, regulatory complexity, payment infrastructure, and cultural alignment with your offerings.

How long does localization take?

Timeline depends on scope. Basic website translation takes 4-8 weeks; comprehensive localization including infrastructure changes, payment integration, and testing requires 3-6 months for the first market. Subsequent markets move faster as processes mature—often 6-12 weeks. Staged rollout approaches balance speed with quality.

Can I use machine translation instead of human translators?

Machine translation works for internal use or getting basic content gist, but professional human translation is essential for customer-facing content. Modern AI-powered translation with human post-editing offers a middle ground—up to 80% faster than pure human translation while maintaining quality. Combine AI for efficiency with human expertise for cultural appropriateness and brand voice.

What are the biggest localization mistakes to avoid?

Top failures include: treating localization as one-time translation project rather than ongoing strategy; ignoring cultural adaptation and only translating text; forcing global standardization instead of adapting to local needs; skipping local payment methods; centralizing decision-making away from market realities; underestimating local competitors; and rushing market entry without proper research.

How do I measure localization success?

Track revenue by market, conversion rates by locale, customer acquisition cost, customer lifetime value, bounce rates, time on site, customer satisfaction scores, and market share. Compare localized vs. non-localized performance through A/B testing. Establish baselines before localization to demonstrate clear impact. Companies implementing full localization typically see 70% conversion rate increases and 20-30% revenue growth.

Do I need different localization strategies for B2B vs. B2C?

Yes. B2B localization prioritizes decision-maker preferences, business etiquette, regulatory compliance, and industry-specific terminology. Sales cycles are longer and relationships matter more. B2C focuses on consumer emotions, payment convenience, and fast transactions. Both require cultural adaptation, but emphasis differs—B2B succeeds through trust and credibility; B2C through emotional connection and friction-free experience.