Why the "Standard" Playbook Fails in Asia

You cannot simply “copy-paste” your US or European outbound strategy into Indonesia, Vietnam, or Singapore.

In the West, directness is efficient. In Asia, it’s often viewed as aggressive or rude. When you combine this cultural friction with an 11-hour time difference and a lack of local brand recognition, your cold emails likely have a <1% open rate.

The Solution: You need a mechanism that builds “digital trust” before you ever ask for a meeting. LinkedIn is currently the only platform that allows you to simulate a local presence and build Guanxi (relationship capital) at scale.

- TL;DR — Key Takeaways

- Trust is the currency: In Asia, people buy from people, not portals. Your profile must signal long-term commitment, not just a transaction.

- Localization isn't just language:It’s about signaling cultural competence (e.g., understanding hierarchy and "face").

- Sales Nav is your radar: Use it to filter for "English Proficiency" and "MNC Experience" to find the path of least resistance.

- The "Soft Ask" wins: Never pitch in the first message. Use a content-led approach to earn the right to a conversation.

If you only do one thing: Audit your profile today. If it doesn’t mention your specific interest or investment in Asia, you are invisible to Asian buyers.

Who this playbook is for (and not for)

This guide is designed for:

-

International Sales Directors tasked with opening new revenue streams in Southeast Asia or East Asia.

-

B2B Founders who want to test Asian demand before hiring a full local team or PEO.

-

Marketing Leaders needing to support a remote sales team with high-quality, localized leads.

This is NOT for:

-

B2C Mass Market brands: If you are selling consumer goods directly to users, you need TikTok, Shopee, or localized Facebook ads, not LinkedIn.

-

Transactional Sales: If your product requires a “one-call close,” the relationship-heavy Asian market may not be the right fit.

Step 1 – Diagnose your market readiness

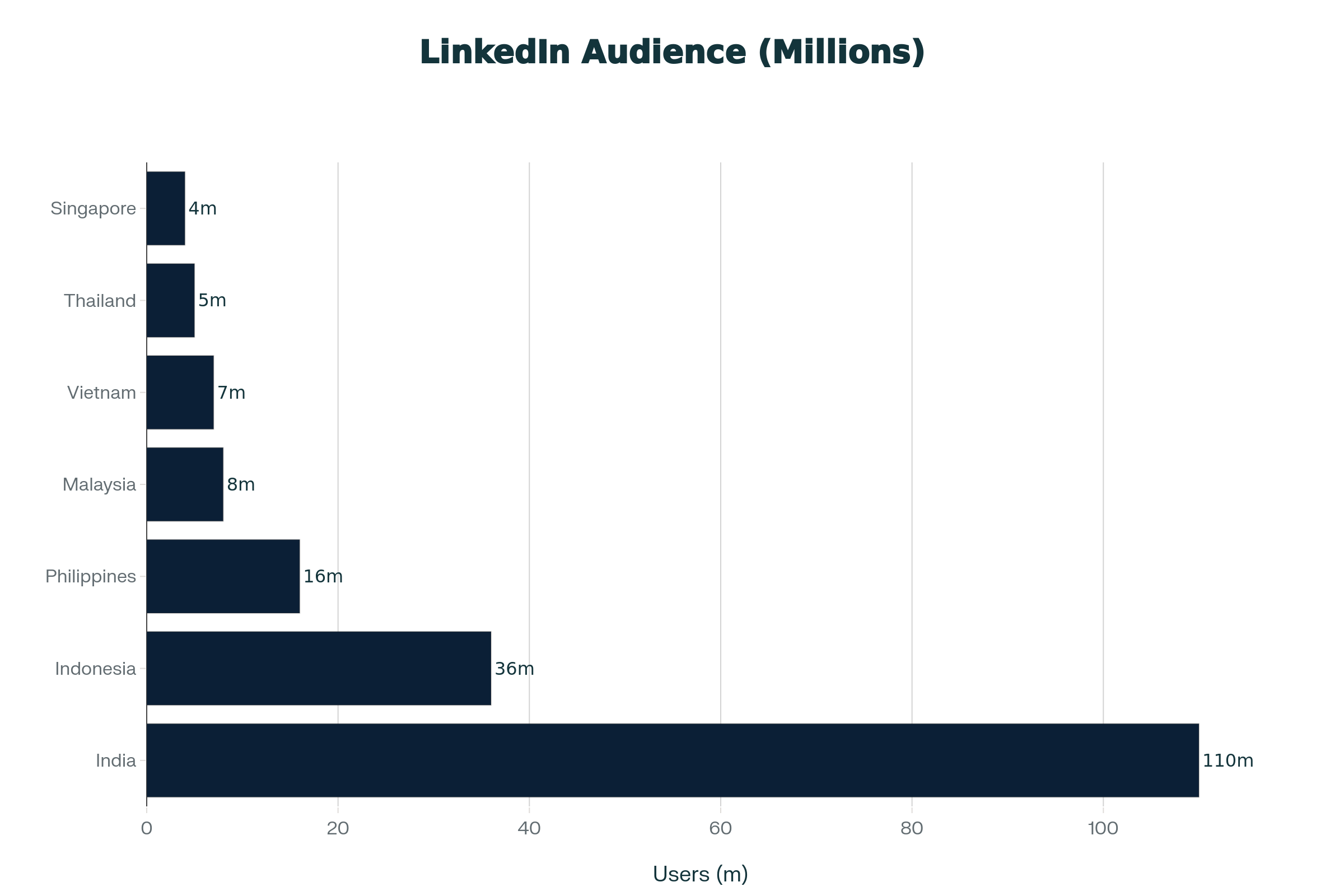

Before you send a single connection request, you must validate the size of your addressable market on LinkedIn. While LinkedIn is dominant globally, its penetration varies wildly across Asia.

The Landscape:

India is a massive volume play, while Singapore acts as the high-value HQ hub. Indonesia and Vietnam are rapidly digitizing but require more localized approaches.

Do this now:

-

Open LinkedIn Sales Navigator.

-

Filter by your target Geography (e.g., “Indonesia”).

-

Filter by Industry and Seniority Level (Decision Makers).

-

Crucial Step: Check the result count. If it’s under 1,000, your niche might be too small for a pure LinkedIn play, and you may need comprehensive market entry consulting.

Addressable B2B Audience on LinkedIn in Key Asian Markets (2025 Estimates). Source: LinkedIn Advertising Reach Data

Step 2 – Design a "Localized" Profile

In cross-border business, your LinkedIn profile replaces your handshake. If your profile screams “I am a foreigner selling to you,” you will be ignored. You need to signal that you are “Asia-Ready.”

The Framework:

-

Headline: Don’t just list your title. Add a regional qualifier.

-

Bad: “VP of Sales at TechCo.”

-

Good: “Helping Manufacturing Leaders in Southeast Asia Modernize Supply Chains | VP Sales @ TechCo.”

-

-

The “About” Section: Address the elephant in the room—distance. Explicitly state your company’s commitment to the region.

Script: “We are expanding our support for the APAC region because we believe in the growth of [Specific Industry]…” -

Featured Section: Upload a case study or one-pager that includes Asian currencies or references local regulations (e.g., PDPA in Singapore).

Expert Insight: “In Asia, ‘Face’ (Mianzi) is real. A sloppy profile implies you don’t respect the person you are meeting. A professional, localized profile gives your prospect ‘face’ by showing you have prepared for them.”

Step 3 –The "Trust-First" Search & Connect

The “Spray and Pray” automation method will get you banned by LinkedIn and blacklisted by Asian buyers. You need a Sniper approach.

The Filter Strategy (Sales Nav):

-

Filter 1: “English” as a profile language. In markets like Japan, Thailand, or Vietnam, this instantly identifies the 20% of buyers who are comfortable doing cross-border deals.

-

Filter 2: “Past Company.” Look for prospects who previously worked at Western MNCs (e.g., Unilever, Microsoft, HSBC). They already understand your business culture.

-

Filter 3: “Groups.” Look for “ASEAN Business Network” or “Expat” groups.

The Connection Request (150-character limit):

Do not pitch. Do not talk about yourself. Focus on relevance.

-

Template: “Hi [Name], saw you are leading ops at [Company] in Jakarta. We’ve been researching the Indonesian logistics boom and your team came up as a leader. Would love to connect. – [Your Name]”

Step 4 – Execute the Content Nurture

Once connected, 90% of your leads will not be ready to buy. You must stay “top of mind” without being annoying.

The “3-2-1” Engagement Rule:

-

3 Likes/Comments: Engage with their content. If they post about a local holiday (e.g., Tet in Vietnam, Diwali in India), comment with a respectful wish. This shows cultural EQ.

-

2 Pieces of “Bridge” Content: Post content that bridges the gap between West and East. E.g., “Trends we are seeing in Europe that are starting to impact Singaporean banking.”

-

1 Direct Message: Only after they engage with you, send a value-add DM.

The “Soft Ask” CTA:

Instead of “Can we meet for 15 mins?”, try:

“We just released a guide on [Topic] specifically for the APAC market. Would you be open to me sending it over? No pressure.”

This approach respects their time and hierarchy, reducing the friction of saying “Yes.”

Ready to Implement These Strategies?

Book a free 30-minute strategy session where we’ll audit your current growth approach and identify your highest-leverage opportunities in Asian markets.

Frequently Asked Questions

1. Should I translate my LinkedIn profile into the local language?

Generally, no. If you are doing cross-border business, English is the standard language of commerce in Singapore, Philippines, and India. For Japan, China, or Vietnam, having a “Profile in Another Language” (a LinkedIn feature) is a nice bonus, but ensure you have the operational capability to reply in that language if they message you back.

2. Is LinkedIn Premium/Sales Navigator worth it?

Yes. For cross-border specifically, the advanced filters (Geography + Language + Company Size) are non-negotiable. Without them, you are wasting time on prospects who cannot buy from you due to language or budget barriers.

3. How do I handle time zones?

Respect theirs. Do not propose a meeting at 3 PM EST (which is 3 AM in Singapore). Use tools like Calendly with pre-set “Asia Slots” (e.g., your late evening, their morning). This small courtesy signals that you are easy to work with.

4. Can't I just buy a lead list?

Buying lists is illegal in many jurisdictions (PDPA/GDPR) and effective in none. In Asia, trust is hard to gain and easy to lose. Spamming a bought list will permanently damage your brand’s reputation before you even start.