The Challenge: Why Most Companies Fail at Asia Market Entry

53% of companies in East Asia identify talent shortages as barriers to transformation. 65% of Asian businesses face new regulations requiring precision compliance strategies. Yet despite these challenges, emerging Asia is projected to contribute $19 trillion in fintech transactions alone by 2025.

The problem isn’t opportunity it’s execution. Companies entering Asian markets without a structured GTM strategy face failure rates exceeding 60%. They underestimate cultural differences, misjudge pricing sensitivities, and fail to adapt their value propositions to local contexts.

This blog gives you a battle-tested framework for launching products and services across Asia’s diverse markets from initial market validation through scaling operations backed by real data, proven strategies, and actionable steps you can implement immediately.

-

TL;DR — Key Takeaways

- Asia accounts for 60% of global economic growth in 2025, making it essential territory for B2B expansion

- Customer acquisition costs in Asia-Pacific average $1.50-$2.00, 60% lower than North America

- 78% of APAC professionals use AI weekly compared to 72% globally, indicating rapid digital adoption

- An 8-step GTM framework specifically designed for Asia's diverse markets reduces entry risks by 40-50%

- Hyper-localization is non-negotiable: every successful Western brand entering Asia adapted extensively

If you only do one thing:

Validate product-market fit in one targeted Asian market before scaling regionally. Companies that test thoroughly before full market entry have 3x higher success rates.

Who this playbook is for (and not for)

This GTM framework is designed for:

B2B technology companies preparing to expand into Asia-Pacific markets for the first time

SaaS and software providers looking to establish product-market fit in Singapore, India, Japan, or Southeast Asia

Enterprise organizations with proven Western success seeking replicable growth in Asian markets

Scale-ups and mid-sized companies ready to invest in systematic market entry rather than ad-hoc experiments

Companies with annual revenues of $5M+ that can commit resources to proper localization and partnership development

This playbook is NOT for:

Early-stage startups without validated product-market fit in at least one market

Companies expecting instant results without investment in localization and cultural adaptation

Businesses unwilling to modify products, pricing, or messaging for Asian audiences

Organizations seeking to apply a single “Asia strategy” across all markets without segmentation

Understanding Asia's GTM Landscape: Why Traditional Approaches Fail

Asia is not a single market, it’s a complex ecosystem of diverse economies, regulatory frameworks, cultural preferences, and digital adoption levels. What works in Singapore rarely translates directly to Indonesia, Vietnam, or Japan.

Key Regional Dynamics Shaping GTM Success

Digital Transformation Acceleration: Over 70% of Asian businesses have accelerated digital transformation initiatives, with AI adoption in India reaching 92%—the highest globally. This creates unprecedented opportunities for B2B technology providers but demands digitally-native GTM approaches.

Mobile-First Consumer Behavior: The Asia-Pacific mobile sector accounted for $950 billion (5.6% of GDP) in 2024, expected to reach $1.4 trillion by 2030. Five of the world’s top ten countries by smartphone penetration are in Asia.

Regulatory Complexity: Each Asian country enforces unique approval schemes, from China’s CCC certification to India’s evolving BIS and telecom standards. Compliance requirements shift frequently, making local expertise essential.

Price Sensitivity and Value Perception: Asian markets demonstrate significant price elasticity. Adobe Creative Cloud costs $59.99 monthly in the U.S. but $22.45 in India—adjustments based on purchasing power parity that preserve premium positioning while ensuring accessibility.

Relationship-Driven Business Culture: Face-to-face interaction and deeper relationship-building outweigh transactional approaches in markets like China, Japan, and Korea. Partnership development timelines extend 2-3x longer than Western markets but yield stronger long-term results

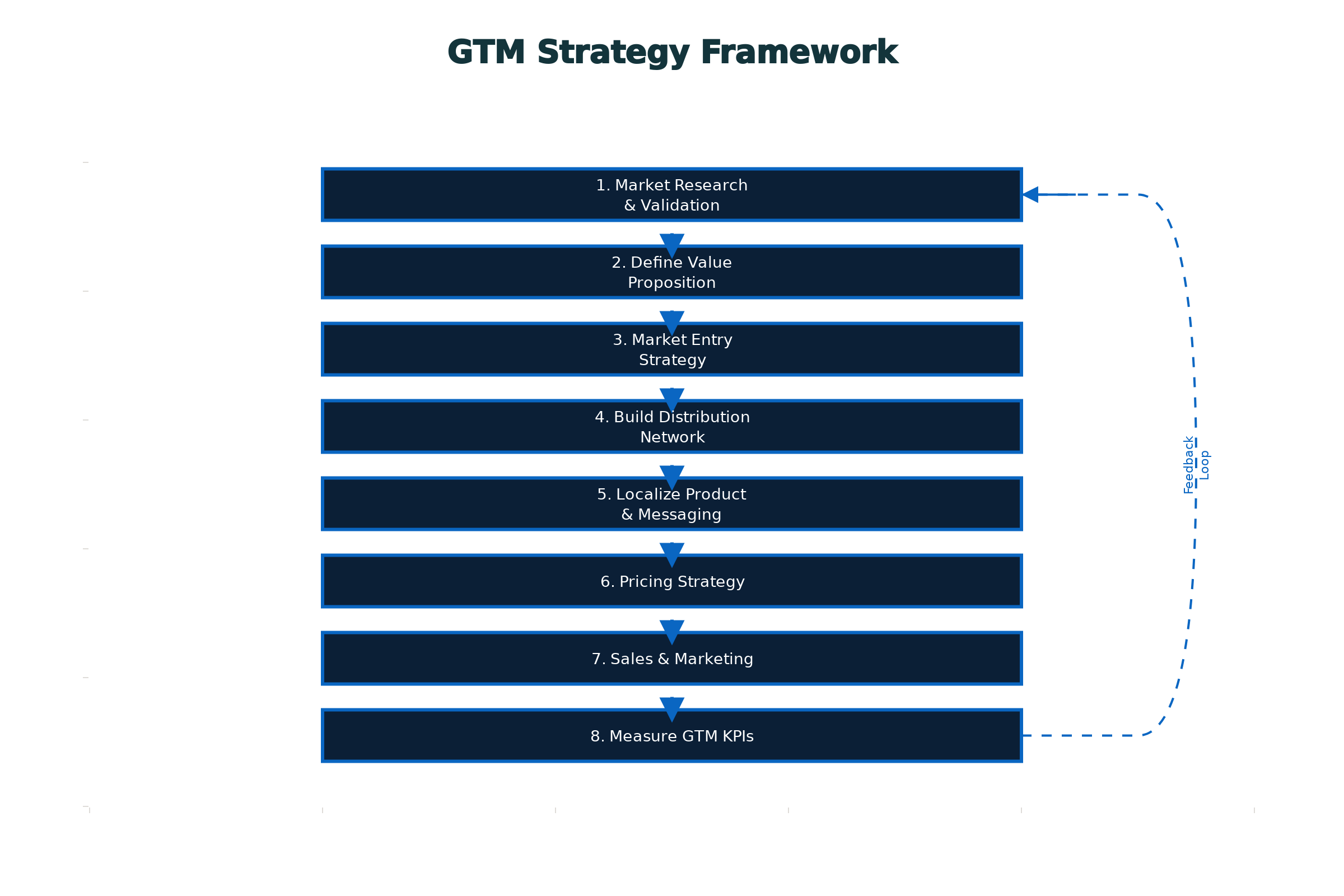

Eight-step GTM framework for successfully launching products and services in Asian markets, with continuous feedback loops for optimization

Eight-Step GTM FRAMEWORK

Step 1: Market Research and Target Validation

Before investing significant resources, conduct rigorous market validation to identify where your product achieves strongest fit.

Conduct Feasibility Studies by Market

Evaluate market size and growth potential across your target countries. Asia-Pacific is projected to experience 3.8% GDP growth, surpassing the global average, with specific sectors like fintech growing at 12.6% annually.

Analyze competitive landscape using structured frameworks. Identify local competitors’ strengths, weaknesses, market share, and positioning strategies. In Indonesia’s piping market, for example, competitors manufacturing locally achieved significantly lower pricing than importers—a critical insight for entry strategy.

Assess regulatory requirements specific to your industry and target countries. Financial services in Singapore require Monetary Authority licenses; healthcare in Malaysia demands both federal and state-level approvals. Partner with regulatory specialists to map compliance timelines and costs.

Validate Product-Market Fit Through Customer Conversations

Conduct 30-50 in-depth interviews with potential customers in your target market before building local teams. Companies that validate assumptions through direct customer discussions reduce market entry failure rates by 40-50%.

Focus discussions on:

Current pain points and workflows

Existing solutions and gaps

Purchasing decision processes and timelines

Price sensitivity and budget allocation

Regulatory or compliance considerations specific to their context

Test MVP in controlled environments. Deploy lightweight, localized MVPs considering local infrastructure—including low- and mid-priced devices common in Vietnam and Indonesia. Integration with local payment systems, social platforms (WeChat, LINE, Kakao Talk), and ecosystems proves essential.

Segment Markets Using a 2×2 Prioritization Framework

Plot potential markets on two axes: market opportunity size versus resource requirements for entry. Prioritize markets with:

Strongest product-market fit indicators from validation

Established local relationships or partnership potential

Favorable regulatory environments for your sector

Sufficient market size to justify localization investments

Step 2: Define Your Value Proposition for Asian Markets

Your Western value proposition rarely translates directly. Asian markets demand culturally-adapted messaging that resonates with local values, preferences, and business practices.

Tailor Benefits to Local Pain Points

Japanese consumers value harmony, craftsmanship, and subtlety in messaging. Indian enterprises prioritize cost-effectiveness and scalability given price sensitivity. Chinese businesses emphasize ecosystem integration and social proof through platforms like WeChat.

Conduct localized messaging workshops with native speakers and cultural consultants to ensure your value proposition:

Addresses region-specific challenges rather than generic global problems

Uses culturally appropriate metaphors, examples, and success stories

Aligns with local business etiquette and communication norms

Develop Market-Specific Case Studies

72% of B2B buyers rely on case studies during vendor evaluation. Create localized success stories featuring:

Companies from the target country or similar regional markets

Industry-specific challenges relevant to local contexts

Quantified outcomes using locally-recognized metrics

Testimonials from credible local business leaders

Adapt Visual Identity and Brand Messaging

Visual elements carry profound cultural weight. White symbolizes purity in Western markets but mourning in parts of Asia. Customize marketing assets to reflect:

Culturally appropriate imagery and color symbolism

Local holidays and traditions (Diwali in India, Lunar New Year in China)

Regional celebrities or influencers as potential brand ambassadors

Step 3: Choose Your Market Entry Strategy

Your entry mode profoundly impacts resource requirements, risk exposure, and speed-to-market.

Four Primary Entry Strategies

Direct Investment (Wholly-Owned Subsidiary): Provides complete control but requires significant capital and assumes full regulatory compliance burden. Best for markets where you possess deep local knowledge or plan long-term major presence.

Joint Ventures: Share risks and leverage partner’s local expertise, relationships, and infrastructure. Starbucks’ partnerships with Sazaby Café in Japan and Tata Group in India exemplify this approach—capitalizing on partners’ operational experience and market knowledge.

Strategic Partnerships and Distribution Agreements: Lower-risk entry enabling you to test markets before major investments. Partner with established local distributors who understand regional nuances, possess existing customer relationships, and navigate regulatory landscapes.

Franchise or Licensing Models: Transfer intellectual property while minimizing direct operational involvement. Works well for proven business models requiring localization rather than fundamental adaptation.

Selection Criteria

Choose your entry strategy based on:

Capital availability and risk appetite: Joint ventures and partnerships reduce upfront investment

Regulatory complexity: Partnering with local entities simplifies compliance in heavily regulated sectors

Market knowledge gaps: If entering unfamiliar territory, leverage partners’ established presence

Speed requirements: Partnerships enable faster market access than building wholly-owned operations

Step 4: Build Your Distribution and Partnership Network

Distribution and logistics form the backbone of successful market entry in Asia. Effective channel management distinguishes market leaders from laggards by approximately 4% in revenue growth and 6% in profit growth.

Identify and Vet Channel Partners

Conduct thorough partner due diligence evaluating:

Market coverage and existing customer relationships

Technical capabilities to support your product or service

Cultural alignment with your values and business practices

Financial stability and reputation in local markets

Negotiate agreements protecting your interests while fostering collaboration. Define clear expectations around territories, performance targets, revenue sharing, and termination clauses.

Leverage Local Platforms and Ecosystems

In China, WeChat reaches 80% of the population, functioning as messaging, social network, and e-commerce platform simultaneously. Establishing presence on dominant local platforms proves essential for visibility and credibility.

Platform strategies vary by market:

China: WeChat for B2C, Alibaba/Tmall for e-commerce

Japan: LINE dominates messaging and mobile commerce

South Korea: Kakao Talk serves as primary communication platform

Southeast Asia: TikTok gaining rapid traction across demographics

Build Relationship Capital Through Face-to-Face Engagement

Business relationships in Asia require sustained personal interaction. Invest in:

Regular in-person visits to key markets for stakeholder meetings

Participation in industry conferences and networking events

After-work gatherings and relationship-building activities beyond transactional discussions

Trust-building timelines extend significantly longer than Western markets but generate partnerships with deeper commitment and loyalty.

Step 5: Localize Your Product and Messaging

Hyper-localization is the mantra—the non-negotiable ingredient in every successful Western brand’s Asian GTM strategy.

Technical and Product Localization

Language and dialect precision: Asia has over 3,000 spoken languages. While Mandarin may suffice in mainland China, Cantonese becomes essential in Hong Kong and Guangdong. Select appropriate languages and dialects for each target market.

Mobile optimization: In many Asian markets, smartphones serve as the primary internet gateway. Craft mobile-centric experiences enabling users to research, shop, and consume content seamlessly on mobile devices. Singapore (88%), South Korea (83%), Hong Kong (79%), Taiwan (78%), and China (74%) demonstrate the world’s highest smartphone penetration.

Integration with local payment systems: Digital payments drive 40.1% of Asia’s fintech expansion. Support region-specific payment methods:

GoPay and OVO in Indonesia

Alipay and WeChat Pay in China

Paytm in India

GrabPay across Southeast Asia

Infrastructure considerations: Optimize for local device capabilities and connectivity speeds. Vietnam and Indonesia commonly use low- and mid-priced devices requiring lightweight applications.

Marketing and Content Localization

Go beyond translation to achieve cultural adaptation that resonates emotionally with local audiences.

Hire native translators, copywriters, and designers with deep cultural knowledge. They catch nuances, idioms, and culturally-specific references that generic translation services miss.

Create region-specific content calendars aligned with local holidays, festivals, and cultural events. Campaigns emphasizing family togetherness during festive seasons or community support initiatives resonate deeply in Southeast Asia.

Adapt brand names and slogans carefully. Some names carry unintended meanings or negative connotations in local languages. Test extensively before launch.

Continuous Adaptation

Localization is an ongoing process, not a one-time project. Consumer behaviors and trends evolve rapidly in Asia’s dynamic markets. Regularly update content, refresh messaging, and stay attuned to shifting preferences.

Step 6: Design Your Pricing Strategy

Pricing significantly impacts adoption, positioning, and profitability across Asia’s diverse economic contexts.

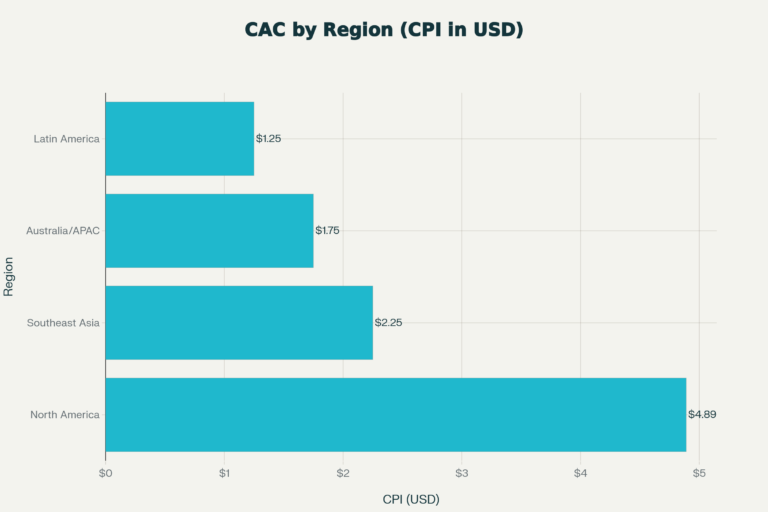

Comparison of customer acquisition costs across regions shows Asia-Pacific markets offer significantly lower CAC than North America, making them attractive for market entry

Regional Pricing Optimization

Adjust prices based on purchasing power parity (PPP) while maintaining brand positioning. This sophisticated approach creates pricing parity across regions while accounting for currency fluctuations and local economic realities.

Netflix provides a compelling example: plans in Bangladesh, India, and Indonesia range from $2.99-$3.99 monthly versus $6.99 in the U.S. and Western Europe. These adjustments lower adoption barriers in price-sensitive markets while preserving global brand equity.

Five Core Pricing Strategies for Asian Markets

Penetration Pricing: Set affordable entry prices to rapidly gain market share in competitive landscapes. This approach works exceptionally well where price sensitivity runs high. Once you establish customer base and brand recognition, gradually increase pricing.

Economy Pricing: Minimize costs to offer rock-bottom prices for budget-conscious segments. Suitable for mass-market products in emerging economies where purchasing power remains constrained.

Premium Pricing: Position as high-quality, exclusive offering justified by superior features, performance, and brand prestige. Works in affluent segments across Singapore, Hong Kong, and major Chinese cities. Adobe maintains premium positioning globally but adjusts absolute prices by region.

Freemium Models: Offer basic functionality free while charging for advanced features. Particularly effective for SaaS and digital products where marginal costs of additional users remain low. Converts free users gradually as they experience value.

Regional Tiering: Create market-specific pricing tiers reflecting local conditions. A leading cosmetics company in Southeast Asia offers premium skincare in hypermarkets and affordable alternatives through convenience stores—segmenting by channel and price point simultaneously.

Pricing Considerations for Distribution Channels

Selling through distribution networks influences pricing structures significantly. Account for:

Partner margins and commission structures

Import duties, taxes, and logistics costs

Competitive pricing benchmarks in each market segment

Currency fluctuation hedging strategies

Step 7: Execute Sales and Marketing Campaigns

With strategy defined and infrastructure established, execute coordinated sales and marketing campaigns leveraging Asia’s unique channels and platforms.

Build Integrated Multi-Channel Campaigns

Winning brands in 2025 deploy integrated campaigns across:

Email marketing with localized messaging

Paid social advertising on region-specific platforms

Retargeting funnels optimized for Asian buyer journeys

Webinars adapted to local time zones and cultural preferences

Messaging apps (WhatsApp, WeChat, LINE) for direct engagement

In-market events and trade shows for relationship building

Ensure messaging consistency across all platforms while adapting format and content to channel-specific best practices.

Leverage AI and Automation for Efficiency

78% of APAC respondents use AI weekly—the highest adoption globally. AI-powered tools transform B2B marketing effectiveness through:

Predictive analytics for lead scoring and opportunity prioritization. Identify prospects most likely to convert and focus resources accordingly.

Email marketing automation with hyper-targeted messaging resonating with specific buyer personas. Personalize outreach at scale based on industry, company size, role, and behavioral signals.

Chatbots and conversational AI providing 24/7 prospect engagement and qualification across time zones.

Align Sales and Marketing with Shared KPIs

Set shared KPIs like MQL-to-SQL conversion rates ensuring sales and marketing alignment. Hold regular meetings between regional teams to maintain coordination.

Build feedback loops enabling marketing to learn from sales conversations—what questions prospects ask, where objections arise, how priorities differ country-by-country. This intelligence continuously refines messaging, content, and campaign strategies.

Partner with Local Experts and Agencies

Tap into regional partnerships to fast-track credibility and market access. Local agencies, resellers, and consultants provide:

Cultural intelligence avoiding costly missteps

Established relationships opening doors more quickly

Market-specific expertise in media buying, content creation, and campaign execution

On-ground presence for events, meetings, and relationship management

Step 8: Measure Performance with GTM KPIs

You can’t manage what you don’t measure. Track specific GTM KPIs enabling data-driven optimization and demonstrating ROI to stakeholders.

Essential GTM KPIs for Asia Market Entry

Customer Acquisition Cost (CAC): Measures total marketing and sales expenses divided by new customers acquired. Asia-Pacific averages significantly lower CAC than Western markets—$1.50-$2.00 versus $4.50-$5.28 in North America.

Track CAC by:

Market (Singapore vs. Indonesia vs. Japan)

Channel (direct sales vs. partner-driven vs. digital)

Customer segment (enterprise vs. mid-market vs. SMB)

Customer Lifetime Value (LTV): Calculate average purchase value multiplied by frequency and customer lifespan. Healthy businesses maintain LTV:CAC ratios of 3:1 or higher.

Sales Efficiency Metrics: Monitor pipeline coverage, deal velocity, average deal size, and win rates by market. These indicators reveal where GTM execution excels or requires adjustment.

Time to Value (TTV): Measure duration from customer signup to first meaningful value realization. Shorter TTV correlates with higher retention and expansion rates.

Net Revenue Retention (NRR): Track revenue growth from existing customers through upsells, cross-sells, and expansions. NRR exceeding 100% demonstrates strong product-market fit and customer satisfaction.

Market Penetration Rate: Calculate percentage of total addressable market captured. Benchmark against competitors to assess relative positioning.

Implement Robust Tracking Systems

Establish unified attribution models tracking customer journeys across touchpoints. Successful Southeast Asian e-commerce brands use multi-channel attribution providing complete views of marketing ROI.

Use CRM and analytics platforms enabling:

Real-time performance dashboards

Cohort analysis comparing customer segments

Funnel conversion tracking identifying bottlenecks

Competitive benchmarking against industry standards

Create Feedback Loops for Continuous Improvement

Review KPIs monthly at minimum, adjusting strategies based on data-driven insights. High-performing organizations foster data-driven cultures where decisions stem from quantitative evidence rather than intuition.

Feed learnings back to product, marketing, and sales teams, creating continuous improvement cycles. Test new messaging, channels, and tactics systematically, doubling down on winners and eliminating underperformers.

Real-World Success Stories: How Companies Conquered Asian Markets

Carsome: From Startup to $2.5 Billion Valuation in Southeast Asia

Carsome, a used-car platform, built a winning GTM strategy through:

Niche market focus: Targeted Indonesia and Malaysia where used-car markets were booming rather than attempting pan-Asia expansion simultaneously.

AI-driven differentiation: Pricing algorithms helped dealers reduce inventory turnover time by 25%, delivering tangible value proposition.

Ecosystem model: Didn’t just sell cars—offered integrated financing and insurance now comprising 60% of gross profit.

Strategic partnerships: Secured $75 million from HSBC’s ASEAN Growth Fund accelerating expansion.

Results: 92% reduction in operating losses between FY2023-FY2024; expanded to seven markets including Japan and Hong Kong.

Netflix: Mastering Localization for Asia

Netflix’s Asia success stemmed from recognizing the region as price-sensitive and content-specific:

Regional pricing: Mobile plans in Bangladesh at $3.99/month, India and Indonesia at $2.99/month versus $6.99 in the U.S..

Content localization: Invested heavily in local-language content production—Korean dramas, Indian films, Japanese anime—resonating with regional audiences.

Payment integration: Partnered with local payment providers reducing friction in transaction processes.

Platform adaptation: Enabled lower-quality streaming options for markets with bandwidth constraints.

Money Forward: $3 Million Deal Through Cultural Adaptation

Japanese fintech company Money Forward initially failed in Southeast Asia due to lack of understanding of local sales processes.

After engaging consulting firms for cultural intelligence:

Trust-building focus: Recognized that relationship development proved non-negotiable in SEA tech sales.

Solution adaptation: Modified IT solutions aligning with specific Malaysian market needs rather than forcing Japanese models.

Stakeholder engagement: Built relationships with decision-makers through sustained personal interaction.

Results: Secured major Vietnamese client FPT and closed $3 million Pre-Series A funding round. Achieved sustainable growth through culturally-adapted approach.

Common Pitfalls to Avoid

Applying One-Size-Fits-All Approaches

Asia is not a monolithic market. What works in Singapore fails in Indonesia; Japanese preferences differ fundamentally from Indian needs. Companies attempting uniform Asia strategies without market-specific adaptation face failure rates exceeding 60%.

Solution: Segment markets rigorously. Develop tailored strategies for each target country based on unique economic, cultural, and regulatory contexts.

Underestimating Localization Requirements

Western companies frequently underinvest in genuine localization, assuming translation suffices. This superficial approach alienates customers and damages brand credibility.

Solution: Budget 15-25% of market entry costs specifically for comprehensive localization—language, cultural adaptation, visual assets, payment integration, and platform optimization.

Ignoring Regulatory Complexity

65% of Asian businesses face new regulations requiring precision compliance. Companies entering markets without regulatory expertise encounter delays, penalties, or denied market access.

Solution: Partner with local legal and regulatory specialists from day one. Map compliance requirements and timelines during feasibility studies. Factor regulatory costs into ROI calculations.

Neglecting Relationship Building

Western transactional sales approaches fail in relationship-driven Asian business cultures. Companies expecting quick closes without sustained engagement lose to competitors willing to invest in trust-building.

Solution: Allocate resources for regular in-person visits, industry event participation, and relationship cultivation. Recognize that longer sales cycles yield stronger, more loyal partnerships.

Premature Scaling Before Validation

Expanding to multiple Asian markets simultaneously without validating product-market fit spreads resources thin and magnifies risks.

Solution: Validate thoroughly in one market before regional expansion. Achieve sustainable unit economics, proven sales processes, and refined messaging before scaling.

Ready to Implement These Strategies?

Book a free 30-minute strategy session where we’ll audit your current growth approach and identify your highest-leverage opportunities in Asian markets.

Frequently Asked Questions

1. How long does it typically take to successfully enter an Asian market?

Market entry timelines vary by complexity and entry strategy. Expect 12-18 months from initial feasibility studies through revenue generation for partnership-based approaches; 18-24 months for wholly-owned operations requiring entity establishment, hiring, and regulatory approvals. Relationship-building timelines in markets like Japan and China extend 2-3x longer than Western markets but yield stronger long-term results.

2. What's the minimum budget required for B2B market entry in Asia?

Minimum viable market entry typically requires $200,000-$500,000 covering market research, localization, partnership development, and initial sales and marketing campaigns. Enterprise-scale entries with wholly-owned subsidiaries demand $1M+ investments. Partnership-based models reduce upfront capital requirements while sharing risks and revenues with local distributors.

3. Should we enter China first or start with Southeast Asia?

Choice depends on product type, resources, and risk tolerance. China offers massive market scale but presents greater regulatory complexity, requires different platforms (WeChat, Alibaba), and demands significant localization investment. Southeast Asia provides more accessible entry points—Singapore and Malaysia offer English-language markets with favorable business environments suitable for testing and learning before tackling larger, more complex markets. Most B2B companies benefit from proving models in Southeast Asia before China expansion.

4. How do we validate product-market fit before significant investment?

Conduct 30-50 customer discovery interviews in target markets, deploy lightweight MVPs with core functionality, and pilot with 5-10 early adopter customers. Track engagement metrics, gather qualitative feedback, and iterate based on learnings. Companies validating thoroughly before full market entry demonstrate 3x higher success rates than those scaling prematurely.

5. What metrics indicate we're ready to scale from one Asian market to others?

Key scaling readiness indicators include: consistent achievement of customer acquisition targets over 6+ months, proven sales playbooks with replicable processes, positive unit economics with LTV:CAC ratios exceeding 3:1, established partnership models transferable to adjacent markets, and clear understanding of localization requirements for target expansion markets. Additionally, ensure operational infrastructure supports multi-market complexity before expanding.

6. How can Expand In Asia help with our GTM strategy?

Expand In Asia specializes in systematic B2B prospecting, product-market fit validation, and customized GTM execution across Asian markets. Services include advanced B2B sales prospecting to identify ideal customers, pipeline management optimizing conversion rates, pre-entry market validation reducing risks, webinar solutions for prospect engagement, strategic LinkedIn outreach, and AI-powered sales automation. With local market knowledge and proven frameworks, Expand In Asia accelerates your path from market entry to sustainable revenue growth.