The Silent Churn Problem

SCENARIO: You’ve successfully closed the deal in Tokyo, Singapore, or Jakarta. The contract is signed, implementation is scheduled, and your sales team is celebrating. But six months later, the account goes dark. The renewal conversation is awkward, and the “upsell” opportunity you forecasted is nonexistent.

Why does this happen?

Most Western B2B companies treat the “Closed Won” status as the finish line. In Asia, it is merely the starting line. The “low-touch,” automated Customer Success (CS) models that work in the US or Europe often fail in Asian markets where business is deeply personal, high-context, and relationship-driven.

The Promise:

This guide provides a structured, 4-step framework to build a post-sales engagement engine specifically designed for Asian markets. You will learn how to transition from “vendor” to “partner,” securing the trust required to unlock expansion revenue.

-

TL;DR — Key Takeaways

- Acquisition is expensive: It costs 5–25x more to acquire a new customer than to retain one. In complex Asian markets, this multiplier is often higher.

- Localization is not just language: True localization means adapting your response times, communication channels (e.g., LINE, WhatsApp), and "face-saving" protocols.

- The "Handshake" never ends: Onboarding in Asia requires ceremonial weight; it cannot be just an email sequence.

If you only do one thing:

audit your QBR (Quarterly Business Review) process to ensure it focuses on relationship health, not just usage metrics.

Who this guide is for (and not for)

This is built for:

B2B SaaS & Service Companies: Specifically those with an Average Contract Value (ACV) high enough to justify dedicated account management.

Expansion Leaders: CROs or VPs managing remote teams in APAC without a full local office.

High-Touch Models: Businesses where success relies on user adoption and complex implementation.

Disqualifiers (Who this is not for):

Transactional B2C: If you are selling low-cost consumer goods, this high-touch framework is overkill.

Pure PLG (Product-Led Growth) with Low ACV: If your product is $10/month, you need automation, not high-touch relationship management.

Step 1 – Diagnose your current "Western Bias"

Before you build a new strategy, you must identify where your current model is leaking value. In many Asian markets, silence doesn’t mean satisfaction—it often means polite dissatisfaction that leads to churn.

The Diagnostic Checklist:

| Metric | The “Western” Standard | The Asian Expectation |

|---|---|---|

| Response Time | 24 hours (Email) | < 4 hours (Instant Messenger) |

| Support Channel | Ticketing Portal (Zendesk) | Chat Groups (WhatsApp, LINE, WeChat) |

| Conflict Style | Direct feedback (“This isn’t working”) | Indirect signals (Silence, delayed replies) |

| QBR Focus | ROI, Usage Stats, Features | Relationship Strength, Future Vision |

Action: Review your last 5 churned Asian accounts. Did they complain loudly, or did they just drift away? If it was the latter, you likely missed the indirect signals.

Step 2 – Design the "High-Context" Model

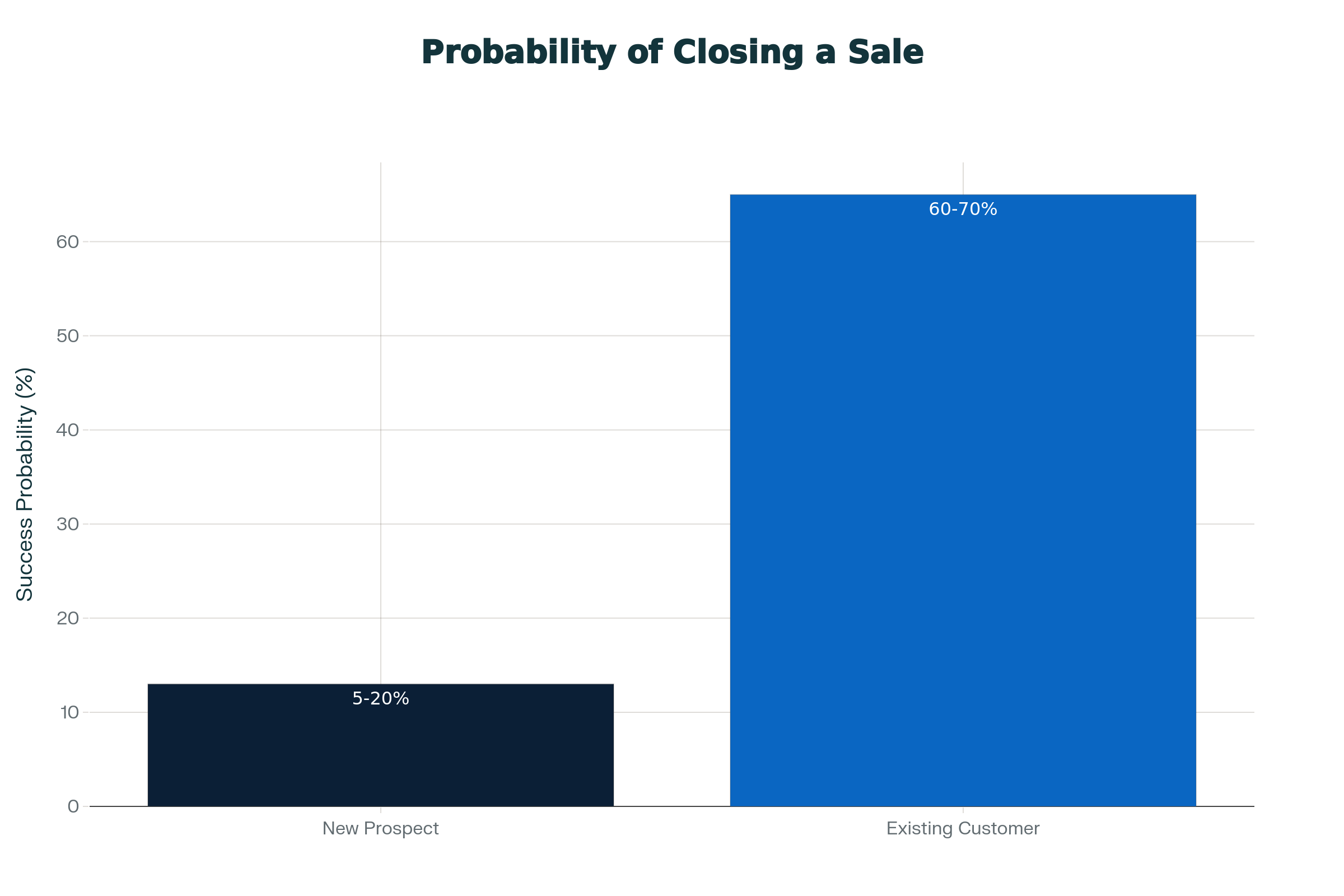

Data confirms that the most profitable path to growth is not new logos, but expanding existing ones.

Probability of selling to a new prospect: 5–20%

Probability of selling to an existing customer: 60–70%

Because the trust barrier is higher in Asia, your post-sales design must prioritize continuity.

The Framework:

Dedicated Local Point of Contact (POC): You cannot manage a high-value account in Jakarta from a timezone 12 hours away. If you don’t have a local entity, use an EOR (Employer of Record) or agency partner like Expand In Asia to place a local Success Manager.

Channel Alignment: Stop forcing them into your ticketing system. If your client uses LINE (Thailand/Japan) or WhatsApp (Indonesia/Singapore/Malaysia), your CS team must be there.

Hierarchy Matching: Ensure your senior leaders show up for key milestones. In hierarchy-conscious cultures (Japan, Korea), a junior CSM cannot effectively advise a client’s VP.

Data Source: Marketing Metrics / Invesp

Step 3 – Execute the Ceremonial Handoff

In the West, the “Sales to CS” handoff is often an internal Slack message and an automated email introduction. In Asia, this is a moment of risk. The client bought the salesperson, not just the product.

The Micro-SOP for Handoffs:

The “Bridge” Meeting: The Sales rep must attend the first post-sales meeting. They are the transferrer of trust.

Formal Introduction: The Sales rep formally introduces the CSM, praising their expertise. This “edifies” the CSM, giving them status in the client’s eyes.

Clear Roles: Explicitly state, “I (Sales) am moving to a supporting role, while (CSM) is now your primary champion for success.”

Why it works: It respects the relationship capital built during the sales cycle and prevents the client from feeling “dumped” after the signature.

Step 4 – The Expansion Loop

Once trust is established, you move to expansion. This is where the 60-70% success probability kicks in.

The 90-Day “Guanxi” Check-in:

Instead of a standard “User Review,” structure your Quarterly Business Review (QBR) as a strategic partnership discussion.

Look Back (Honoring Commitments): Show explicitly how you delivered on promises made during the sales cycle.

Look Forward (Joint Vision): Ask, “Where is your company going next year?” before pitching new features.

The “Soft” Upsell: “Based on your goal to expand into Vietnam, our Premium tier has multi-currency support that would solve that specific headache.”

Proof Point: Increasing customer retention by just 5% can increase profits by 25% to 95%. In high-growth Asian markets, this stability provides the cash flow needed for aggressive acquisition elsewhere.

Ready to Implement These Strategies?

Book a free 30-minute strategy session where we’ll audit your current growth approach and identify your highest-leverage opportunities in Asian markets.

Frequently Asked Questions

1. Do we really need a local speaker if our clients speak English?

Yes. While many Asian business leaders speak English, nuance is often lost in a second language. A local speaker picks up on hesitation, tone, and cultural context that an English-only speaker will miss. It also signals respect and commitment to the market.

2. Can we automate the onboarding process to save costs?

You can automate the technical setup, but not the relational setup. In Asia, high-touch onboarding is a competitive differentiator. If you automate the relationship, you become a commodity, and commodities are easily replaced by cheaper local competitors.

3. How do we handle time zones without a 24/7 team?

You don’t need 24/7 support immediately. You need overlap. having a team member (or partner agency) working Asian hours is critical. A response that comes at 3 AM local time is useless to a client trying to solve a problem at 2 PM.

4. What is the biggest mistake companies make in Asian QBRs?

Treating it as a “report card” rather than a relationship builder. Avoid purely metric-driven meetings. Spend time on face-to-face (or video) interaction that strengthens the personal bond between your teams.