High‑value enterprise accounts in Asia rarely come from generic lead gen.

They come from carefully chosen accounts, localized outreach, and tight sales–marketing orchestration.

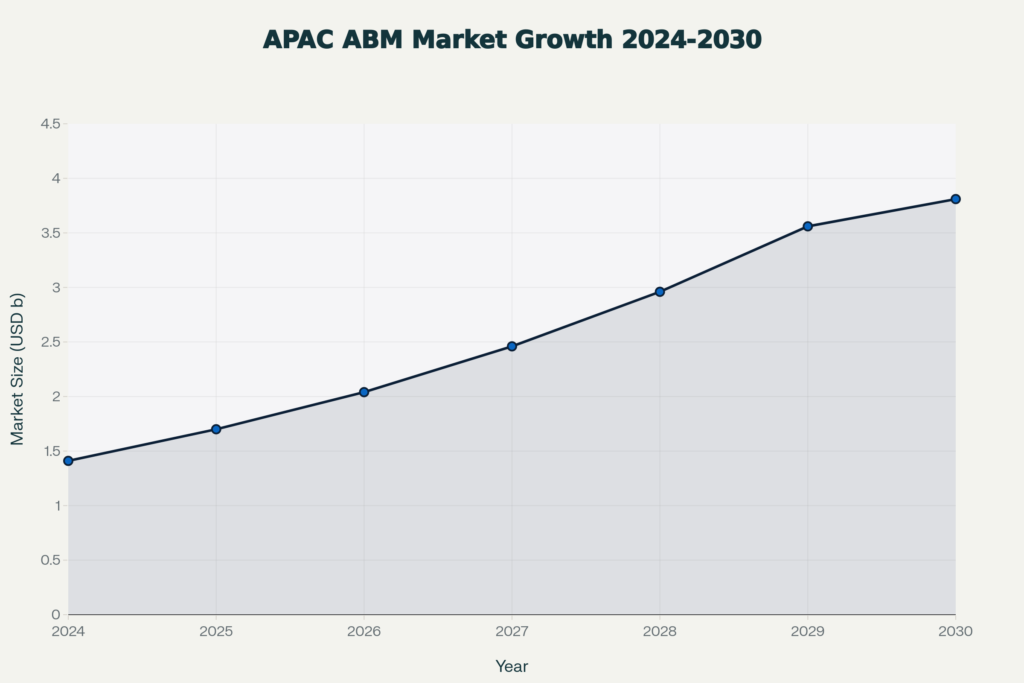

At the same time, competition for decision‑makers’ attention is rising. The Asia‑Pacific ABM market is the fastest‑growing globally, with growth projections above 15–18% CAGR through 2030 as more B2B firms adopt ABM programs. Forrester’s 2024 data shows that ABM programs deliver 21–50% higher ROI than non‑ABM marketing, with nearly a quarter of respondents reporting 51–200% higher ROI. Salesforce reports that B2B companies using ABM see higher win rates and larger deal sizes compared to non‑ABM programs.

Yet many international teams still apply “copy‑paste” ABM from North America or Europe into Asia—treating the region as one market, underestimating local buying dynamics, and struggling to convert.

This article lays out a practical, outcome‑driven ABM playbook designed specifically for Asia, rooted in how B2B buyers actually evaluate and purchase in markets like Singapore, Japan, India, Indonesia, Korea, and beyond. It also shows where a specialist partner like Expand In Asia fits into each step—across B2B prospecting, pipeline management, product‑market fit validation, LinkedIn outreach, webinars, events, and AI‑enabled sales operations.

You will walk away with:

-

A clear view of whether ABM is the right next move for your Asia strategy

-

A 5‑step ABM framework tuned for Asian markets

-

Concrete plays your team can adapt immediately (with or without a large martech stack)

-

A mini case study of ABM in Asia to benchmark against

-

TL;DR — Key Takeaways

- Treat Asia as a portfolio of markets, not one region. Build market‑specific ICPs and target lists (e.g., ASEAN vs. Japan vs. India) before you invest in content or ads.

- ABM in Asia works best when sales and marketing act as one team on a defined account list. Firms using ABM see higher win rates, larger deal sizes, and better retention.

- Use multi‑channel engagement tailored to local behavior: LinkedIn and webinars in Singapore, partner events in Japan, WhatsApp/LINE/WeChat where appropriate, and in‑person events where relationships drive deals.

- Leverage intent data and AI where possible to prioritize in‑market accounts; in APAC, 45% of marketing leaders already say generative AI is shaping their ABM strategies and 58% see cost reductions from AI.

- Measure at the account level (engagement, pipeline, expansion) rather than just leads. ABM practitioners report improvements in pipeline conversion, revenue per account, and client expansion.

If you only do one thing:

Align sales and marketing around a single, tiered target account list for Asia, then design all outreach, content, and events around moving those accounts through a defined journey.

Who this playbook is for (and not for)

This playbook is for you if:

-

You sell B2B solutions (SaaS, tech, services, industrial, or financial) with high contract values and multi‑stakeholder buying committees.

-

Asia is a priority growth region and you already generate some demand, but conversion from interest to qualified opportunity is inconsistent.

-

Your sales and marketing teams are willing to align on a named list of accounts and shared metrics.

-

You want to move from lead volume to revenue and relationship depth in targeted markets.

It is not a fit if:

-

Your sales model is high‑velocity, low‑ACV, with minimal sales involvement and self‑serve conversion.

-

You lack capacity to engage deeply with accounts (no sales access, no follow‑up process, or no ability to localize messaging).

-

You are looking for a short‑term lead spike rather than structured, compounding pipeline from defined target accounts.

Step 1 – Diagnose your current state

Before launching ABM in Asia, start with a clear, honest diagnostic. Many ABM programs underperform because they are layered on top of unclear ICPs, fragmented data, and inconsistent follow‑up.

1.1 Assess strategy and fit

Review these dimensions:

-

ICP clarity per market: Do you have a documented ideal customer profile for each priority market (e.g., Singapore mid‑market financial services vs. Japanese large manufacturers)?

-

Sales–marketing alignment: Do both teams agree on target industries, company sizes, and buying centers?

-

Coverage and data quality: Do you have clean contact and account data (decision‑makers and influencers) in each target country?

-

Current channels: Which channels already bring you opportunities in Asia (events, partners, inbound, outbound, referrals)?

-

Content and assets: Do you have relevant case studies, webinars, or localized materials for your top industries in Asia?

A partner like Expand In Asia typically begins with product‑market fit validation and ICP research across key Asian markets to ensure ABM efforts focus on accounts with the highest probability of conversion and expansion.

1.2 Quick diagnostic checklist

Answer “yes”, “partially”, or “no” to each:

-

ICPs documented and validated for at least 2–3 priority Asian markets

-

Single, shared account list for sales and marketing per market

-

Visibility into account‑level engagement (website visits, email opens, event attendance, LinkedIn engagement)

-

Clear follow‑up SLAs for SDRs/BDRs and account executives

-

At least a few Asia‑relevant proof points (local logos, regional case studies, or pilot results)

If several of these are “no” or “partial”, an ABM initiative should start with foundational work—where services like B2B prospecting, ICP validation, and pipeline management from Expand In Asia provide the data and structure ABM needs to succeed.

Step 2 –Design an ABM approach for Asia, not “any market”

Asia is not one market. Effective ABM in the region recognizes:

-

Different decision‑making norms (consensus‑driven in Japan, relationship‑heavy in parts of Southeast Asia, speed‑oriented in some tech hubs).

-

Different dominant channels (LinkedIn in Singapore and India, strong local media and events in Japan and Korea, messaging platforms in many emerging markets).

-

Different regulatory and data‑privacy regimes.

2.1 Choose your ABM model(s)

Common models:

-

1:1 ABM: Deeply customized for a small number of strategic accounts.

-

1:few ABM: Clusters of 10–50 similar accounts (e.g., “tier‑1 banks in ASEAN”).

-

1:many ABM / programmatic: Larger segments with modular personalization at scale.

In Asia, many firms adopt a hybrid:

-

1:1 for strategic logos in Japan, Singapore, or regional HQs.

-

1:few for vertical clusters (e.g., fintechs in India, manufacturers in Vietnam and Thailand).

-

1:many for broader awareness and nurturing of future in‑market accounts.

2.2 The 4‑step ABM execution framework for Asia

A simple way to structure your regional ABM motion:

-

Account Selection & Research – Define and prioritize accounts by market, industry, and buying center.

-

Personalized Content & Offers – Build narratives and assets tailored to each segment and market.

-

Multi‑Channel Engagement – Orchestrate touches across LinkedIn, email, webinars, events, and partners, aligned to local preferences.

-

Pipeline Conversion & Measurement – Track account‑level engagement, opportunities, and revenue; refine based on what converts.

Step 3 – Build and prioritize your account list in Asia

ABM success hinges on choosing and structuring the right accounts.

3.1 Define your ICPs by sub‑region

Start with 2–3 priority clusters, for example:

-

Singapore & Hong Kong HQs: Regional decision‑makers, often English‑first, strong LinkedIn penetration, heavy webinar and thought‑leadership consumption.

-

Japan & Korea: Preference for local language, strong value placed on references and long‑term relationships, events and partners often key.

-

India & ASEAN (e.g., Indonesia, Thailand, Vietnam, Philippines, Malaysia): High growth, mobile‑first, often price‑sensitive but open to new vendors if localized and backed by clear ROI.

Use data points such as:

-

Existing customer distribution in Asia

-

Win/loss patterns by industry and country

-

Average deal size and sales cycle length by market

-

Local competition and partner landscape

This is where product‑market fit validation and ICP research help identify where to focus first, rather than trying to “do ABM” across all of Asia at once.

3.2 Build a tiered account list

Group accounts into tiers:

-

Tier 1: Strategic accounts where 1:1 efforts are justified (large regional enterprises, global logos with Asia HQ).

-

Tier 2: Strong‑fit accounts for 1:few ABM (similar firmographics, problems, and buying centers).

-

Tier 3: Broader good‑fit accounts for lighter, programmatic ABM.

Ensure that:

-

Sales co‑owns the list with marketing.

-

Each account has at least one named account owner.

-

Basic account data is complete (HQ location, core business, tech stack where relevant, key initiatives).

Expand In Asia’s B2B prospecting services can help fill in missing stakeholders, validate contact data, and prioritize accounts by intent and fit across Asian markets.

3.3 Map buying centers and stakeholders

In Asia, buying committees can be larger and more cross‑functional than expected. Map:

-

Business owners (e.g., Head of Operations, Head of Retail Banking)

-

Technical evaluators (e.g., CIO, CTO, security, data teams)

-

Finance and procurement

-

Local influencers (e.g., local country managers, regional HQ roles)

Build a simple account plan for top tiers: objectives, key messages, likely objections, and first‑step offers.

Step 4 – Execute the ABM play: multi‑channel, local‑first

With the account list in place, shift to orchestrated execution. ABM in Asia is about right accounts + right channels + right timing, not just more impressions.

4.1 Orchestrate channels by market

Examples of channel mixes that often work in Asia, depending on the segment:

-

LinkedIn + email + webinars

-

Strong in Singapore, Hong Kong, India, Australia, and tech‑savvy clusters across ASEAN.

-

Combine targeted LinkedIn outreach and ads with role‑specific email sequences and regionally timed webinars.

-

Expand In Asia’s LinkedIn outreach and webinar solutions fit naturally here.

-

-

Events + executive roundtables + partners

-

Effective in Japan, Korea, and some sectors in Southeast Asia where face‑to‑face interaction builds trust.

-

Use ABM to fill event rooms with specific accounts, then follow up with tailored content and meetings.

-

Expand In Asia’s Event Traffic Engine can focus pre‑event invitations and follow‑up on named accounts.

-

-

Localized content + messaging apps + field sales

-

In markets where WhatsApp, LINE, or WeChat are dominant, ensure compliance and work via sales or partners to continue conversations off email.

-

Provide local language one‑pagers, case studies, and short videos to equip frontline teams.

-

4.2 Why this multi‑channel ABM approach works in Asia

-

Buyers see consistent messaging across touchpoints, tied to their market context.

-

Sales and marketing appear coordinated, increasing perceived professionalism.

-

ABM aligns with how B2B buyers in Asia consume information—through a mixture of digital, events, and personal networks.

Forrester and other analysts consistently report that ABM programs deliver higher ROI, larger deal sizes, and improved pipeline performance versus non‑ABM approaches, including in Asia Pacific.

4.3 Micro‑SOP: running a regional ABM campaign

For each priority cluster (e.g., “Top 50 ASEAN banks”):

-

Confirm account list and owners

-

Lock the tiered list and assign account owners.

-

-

Define the campaign theme

-

Anchor on a specific, high‑value problem (e.g., “fraud prevention in digital banking across ASEAN”).

-

-

Create or adapt assets

-

One core thought‑leadership piece (whitepaper, webinar, or playbook)

-

2–3 localized case studies (preferably from Asia, if available)

-

Short email and LinkedIn copy tailored to roles

-

-

Plan channel cadence (6–8 weeks)

-

Week 1–2: LinkedIn profile optimization and connection outreach; warm‑up emails

-

Week 3–4: Webinars or executive roundtables; targeted ads as support

-

Week 5–6: 1:1 follow‑ups, meeting requests, and account‑specific content

-

-

Run weekly stand‑ups between sales and marketing

-

Review account engagement and pipeline movement

-

Adjust messaging, offers, and targeting based on live feedback

-

-

Close the loop

-

Document which accounts moved forward and which didn’t, and why

-

Feed learnings back into ICPs and next wave of campaigns

-

Expand In Asia typically supports this phase through:

-

Sourcing and validating the right contacts in target accounts

-

Managing outbound sequences (email + LinkedIn)

-

Driving registrations and attendance for webinars and events

-

Coordinating with internal sales teams to ensure timely, localized follow‑up

4.4 Using AI and intent data responsibly

In 2024, over 45% of APAC marketing leaders reported that generative AI has shaped their ABM strategies, and 58% said AI is helping reduce costs in their programs. Practical uses include:

-

Identifying in‑market accounts based on topic and intent signals

-

Drafting localized outreach that is then reviewed by native speakers

-

Surfacing account‑level engagement patterns for sales to act on quickly

Use AI as an accelerator, not a replacement, for human understanding of local context and relationships.

Step 5 – Measure, learn, and scale what works

ABM success in Asia is measured at the account and revenue level, not just form fills.

5.1 Core ABM metrics to track

Align your reporting around:

-

Account engagement

-

Number and percentage of target accounts with meaningful engagement (meetings, webinar attendance, content consumption).

-

-

Pipeline metrics

-

Opportunities created from target accounts

-

Pipeline value from ABM accounts vs. non‑ABM accounts

-

Pipeline conversion rates (e.g., from opportunity to closed‑won)

-

-

Revenue and deal quality

-

Average deal size for ABM vs. non‑ABM deals

-

Win rate from ABM accounts (Salesforce data shows higher win rates and up to 91% larger deal sizes for ABM programs).

-

-

Retention and expansion

-

Retention rate and expansion revenue from ABM accounts; many marketers globally and in Asia report ABM as a key lever for retaining and expanding existing client relationships.

-

Gartner‑referenced research highlights that ABM can increase overall pipeline conversion rates and revenue contribution versus traditional models, while Forrester data shows significant ROI uplifts.

5.2 Continuous improvement loop

For each ABM cycle:

-

Review: Which markets, verticals, and plays created the strongest pipeline and revenue?

-

Refine: Update ICP definitions, tiering logic, and content priorities.

-

Re‑allocate: Move budget from broad, low‑yield activities to higher‑performing ABM motions.

Pipeline management and AI sales automation services from Expand In Asia can help standardize this loop—ensuring that insights from one campaign are reused across markets instead of starting from zero each time.

Why ABM is a priority in Asia right now

Several recent trends make ABM particularly relevant in Asia:

-

Fastest regional ABM growth: Asia‑Pacific is the fastest‑growing ABM region globally, with projected CAGRs around 15–18% through 2030 as adoption accelerates.

-

Budget shifts into ABM: In APAC, 43% of marketing leaders plan to increase ABM budgets, up from 28% the year before.

-

High perceived success: Studies show that a high proportion of marketers in Asia—particularly in China—rate their ABM efforts as successful or highly successful.

-

AI adoption in ABM: Over 90% of senior marketing leaders in APAC expect to increase AI usage in their ABM strategies over the next two years.

A representative market forecast shows Asia‑Pacific’s ABM market value rising strongly over the coming years.

This growth reflects a shift from broad demand generation to account‑centric engagement, especially in sophisticated B2B categories like SaaS, cybersecurity, fintech, and industrial technology.

Ready to Implement These Strategies?

Book a free 30-minute strategy session where we’ll audit your current growth approach and identify your highest-leverage opportunities in Asian markets.

Real‑world example: ABM‑driven growth in Asia

A number of case studies illustrate how structured ABM and account‑centric content can drive significant results in Asia.

One public example involves Lenovo’s “Tech Revolution” program, a digital content platform aimed at IT decision‑makers across Asia‑Pacific. By combining ABM principles and social‑selling tactics, the initiative focused on targeted, high‑value accounts and delivered USD 66 million in revenue via ABM and social selling within 12 months, demonstrating clear ROI in the region.

Situation → Trigger → Barrier → Solution → Results

-

Situation: Global technology vendor aiming to deepen penetration in APAC enterprise accounts, selling complex solutions across banking, retail, and other verticals.

-

Trigger: Need to move beyond generic campaigns and broad brand awareness toward account‑specific engagement with IT and business decision‑makers.

-

Barrier: Diverse markets, fragmented buying centers, and noisy digital channels made it difficult to reach and influence the right stakeholders efficiently.

-

Solution:

-

Defined clusters of high‑value accounts by industry and region.

-

Created a content hub (“Tech Revolution”) with topics tailored to IT decision‑makers in Asia.

-

Drove targeted traffic from specific accounts using ABM tactics and social selling.

-

Coordinated marketing and sales activities against a shared account list.

-

-

Results (snapshot):

-

USD 66 million in revenue attributed to ABM and social selling initiatives.

-

Tangible ROI demonstrated within 12 months.

-

Stronger relationships with key enterprise accounts across Asia.

-

Snapshot box:

-

Company type: Global technology vendor

-

Segment: Enterprise and upper mid‑market, multi‑country APAC

-

Region: Asia‑Pacific

-

Time‑to‑value: 12 months to demonstrate clear ROI

-

Key KPI moved: Revenue attributed to ABM and social selling (USD 66 million)

This type of motion targeted content and outreach anchored in an account‑centric strategy is exactly where specialized partners with deep Asia experience, such as Expand In Asia, can help de‑risk execution and accelerate impact.

Frequently Asked Questions

1. Is ABM in Asia only for large enterprises?

No. While ABM is often associated with very large enterprises, mid‑market B2B companies with considered sales cycles and multi‑stakeholder deals can benefit significantly. The key is to right‑size the program: fewer accounts, a focused vertical, and pragmatic tools rather than a full enterprise ABM stack.

2. How many accounts should we start with in Asia?

For a first wave:

-

10–20 Tier 1 accounts for 1:1 or highly tailored 1:few ABM

-

30–80 Tier 2 accounts for more scalable plays

Starting smaller improves focus and makes it easier to learn and refine before expanding to more markets or segments.

3. Do we need an expensive ABM platform to start?

Not necessarily. Many teams in Asia begin with:

-

Their existing CRM and marketing automation

-

Intent and enrichment data where available

-

Structured account plans and regular sales–marketing meetings

ABM platforms can add value as programs mature, but the strategy and alignment matter more than tools in the early stages.

4. How localized does our content need to be?

Localization depends on the market and audience:

-

In markets like Japan and Korea, local language and locally relevant proof points significantly improve trust and conversion.

-

In regional hubs like Singapore and for regional HQ roles, high‑quality English content with Asia‑specific data and examples can be sufficient.

-

For emerging markets in ASEAN and South Asia, local context (regulation, infrastructure, market maturity) is often more important than full translation.

A practical approach is to localize your most important content assets for your highest‑value markets and segments first, then expand based on results.

5. How long does it usually take to see results from ABM in Asia?

Time‑to‑impact varies by sales cycle and market:

-

Early signals (higher engagement from target accounts, more meetings) can appear within 4–8 weeks of a well‑run campaign.

-

Meaningful pipeline shifts often emerge over 1–3 quarters, especially for complex B2B solutions.

-

Full revenue impact may align with your typical sales cycle (often 6–18 months for enterprise deals).

Case studies like Lenovo’s APAC program show that clear ROI can be demonstrated within about 12 months when ABM is well structured and aligned with sales.

6. How does ABM interact with our existing demand generation?

ABM does not replace all demand generation. Instead, it:

-

Focuses resources on your most valuable accounts in Asia

-

Sits alongside broader demand gen and brand programs

-

Creates a feedback loop: insights from ABM inform broader campaigns and vice versa

A partner like Expand In Asia can help design how ABM, outbound prospecting, events, and webinars work together rather than compete for budget.